Monday in Brief: 1/27/25

It is . . . still January.

Hello hello,

By the end of the week, most places in the U.S. will have already had their coldest week of the year. Things are heating up, indeed!

So without further ado:

Monday in Brief for 1/27/2025:

Don’t jinx it, David.

From the article (emphasis added):

Sources tell the Prospect that Trump’s team has run into difficulty finding anyone who wants to take the job, with the directive to essentially halt all this work. Kraninger, who held the position from 2018 to 2021 and is now CEO of the Florida Bankers Association; Brian Johnson, one of Kraninger’s top aides who now runs compliance for Capital One (which was just hit with a CFPB lawsuit for cheating customers out of interest payments); and former Trump FDIC chair Jelena McWilliams have all been offered the job and turned it down. . . . A fourth candidate, former Trump Treasury official Craig Phillips (who has also worked for Morgan Stanley and BlackRock), decided to go to Freddie Mac instead.

Meanwhile, from the Bureau: CFPB Finds More Vehicles Eligible for Repossession Than Pre-Pandemic

Vehicles eligible for repossession exceeded pre-pandemic levels: In the month of December 2022, 0.75% of all outstanding vehicle loans were assigned to repossession – a 22.5% increase from December 2019 (0.61%).

Repossessions completed using forwarders had higher costs charged to borrowers: Lenders’ use of third-party repossession forwarding companies increased from 31% in January 2018 to 66% in December 2022. Average repossession costs charged to consumers were higher when a forwarder was used.

Consumers still owed thousands after repossession: Consumers can continue to owe money on their vehicle even after it is repossessed and sold by the lender. The average outstanding balance for consumers that had an outstanding balance after repossession in December 2019 was more than $10,000. Following a brief drop, the average outstanding balance sharply increased and was more than $11,000 in December 2022.

FTC Commissioner Alvaro Bedoya reminds us of the importance of minority commissioners with a scathing review of the new Chair.

If you have time to read one thing this week: “How unrelenting greed led to the downfall of The Hartford Courant.” (Yup, private equity.) The piece has many great/infuriating bits like this one:

Eventually, plummeting profits, despite constant staffing cuts, led to [the Courtant’s then-owner] Tribune’s disastrous sale to private equity mogul Sam Zell for $8.2 billion in 2007. An avid biker, Zell’s tenure had the Courant enduring one vertiginous wheelie after another before the wheels came off in 2008, when Tribune Co. filed for bankruptcy.

As the Chicaco Tribune later reported, Tribune executives got nearly $150 million in cashed-out stock and other payments, while the company was saddled with a $13 billion debt. Courant employees started wearing a T-shirt that said “The Chairman of the Board walked off with $41 million and all I got was this lousy T-shirt.”

Elsewhere in PE: Child Death Sparks Reconsideration of Private Equity–Owned Affordable Housing

Banks behaving badly (1): Whistleblower alleges JPMorgan misreported trading data to game capital requirements—with “tacit approval” from the Fed.

But but NB this article’s crucially incorrect description of capital as “reserves” that banks “hold,” and that they want to minimize because those funds “could otherwise be invested, distributed to shareholders or loaned out.” See Anat Admati here.

Banks behaving badly (2): New York AG Letitia James gets past Citibank’s motion to dismiss a suit claiming the bank “failed to protect customers from online scammers and refused to reimburse customers who were victimized.”

Check out the amicus brief the CFPB submitted in that case here.

Bank regulators behaving badly: Something something very serious people, adults in the room, central bank independence. Anyway, here’s Michigan Law prof. Jeremy Kress on X:

Good for progressives to remember the next time around.

Sheila Bair in the FT: “Credit scores are hazardous to your financial health” (endorsing cash flow underwriting, if with some additional rhetorical trappings that we do not endorse).

Wait, DOGE with a good take (no, no, let’s be very cautious here)? Ben Miller at Bloomberg Law: SEC-CFTC Merger Debate Revived as DOGE Looks to Trim Agencies.

The above is right about the CFTC’s genesis, but it leaves out that CFTC continues to exist mostly so that members on the Senate Ag committee can raise funds by promising opportunities for regulatory arbitrage to financial fraudsters and others introducing novel, risky products.

America is now free from the tyranny of supporting basic science research.

Shunting things to committees means we won’t end up with a strategic bitcoin reserve, right? Right?? NBC: Trump orders administration to evaluate potential for 'national digital asset stockpile'.

GAO unpacks the FDIC’s emergency expansion of deposit insurance during the 2023 SVB/Signature/etc crisis. From that (emphasis added):

GAO’s analysis found that the Treasury Secretary invoked the systemic risk exception for each of the banks after taking into consideration the regulators’ recommendations and consultations with the President. . . . The decision allowed FDIC to protect all deposits at the two failed banks, including uninsured deposits. GAO’s analysis of selected financial and economic indicators suggests that FDIC’s actions likely helped prevent further financial instability. For example, deposit outflows from commercial banks other than the 25 largest banks slowed in the week after the bank failures and stabilized the following week. How these indicators would have performed without the systemic risk exception is unclear. Protecting all deposits can create moral hazard by reducing bank and depositor incentives to manage risk, as they may expect future bailouts, according to selected literature. Financial regulatory reforms proposed by regulators and introduced in Congress, including changes to deposit insurance and to capital requirements, may help address these concerns.

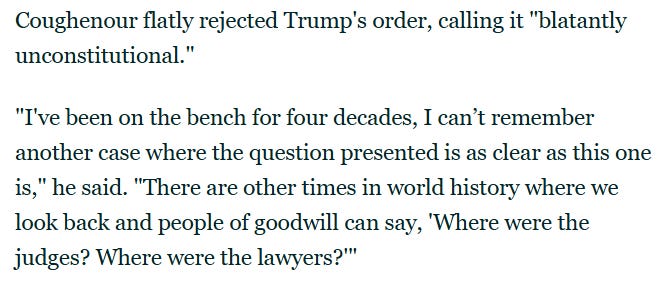

And finally: looking around this week, you may have wondered, “where are the lawyers?” A Reagan-appointed judge had the same thought on Thursday when he took DOJ to task over the President’s order rescinding birthright citizenship:

Have a good week!