This Week In Debt: 1/12/2026

Ideology, student loans, etc.

Hello,

Let me be pretentious for a moment so that I can make a point about student loans. I have not read all of de Tocqueville’s Democracy in America, but there is a memorable part where the author notes how differently Americans and Europeans see crime:

The European generally submits to a public officer because he represents a superior force; but to an American he represents a right. In America it maybe said that no one renders obedience to man, but to justice and to law.

. . .

[And so, in] Europe a criminal is an unhappy being who is struggling for his life against the ministers of justice, whilst the population is merely a spectator of the conflict: in America he is looked upon as an enemy of the human race, and the whole of mankind is against him.

In so many words, de Tocqueville says we find crime uniquely offensive in the U.S. because we see it as a slight against all of us.

That section of Democracy in America came to mind when I saw the news that certain forms of student debt cancellation will count as ordinary, taxable income starting in 2026, setting off a likely “tax bomb” for millions.

The type of cancellation at issue here involves so-called “income-driven repayment” (IDR). Very briefly, IDR is a protection that lets low-income federal student loan borrowers reduce their monthly student loan bills. They end up paying a small percent of their income toward their loans each month, hence the name. IDR also provides debt cancellation for borrowers who have been in repayment for up to 25 years based on the specific kind of loans and payment plan they have. Cancellation under IDR involves borrowers forgoing an average of about $50,000 in debt.

Because of the Big Bad Bill, however, any amount of cancellation that borrowers get via IDR will now count as ordinary, taxable income. Analysis from Protect Borrowers shows that the ensuing tax bill could cost working class people tens of thousands of dollars in added charges and lost benefits.

It is not obvious why we would tax the use of IDR, or where low-income student loan borrowers are expected to get the money to make that tax payment. I submit to you that this change is basically about ideology.

I often say around here that financial services companies are whiny, and a meme I shared once gets at a related point: it often seems like companies want us not just to pay for their services, but also to thank them for their service.

The IDR tax story illustrates how American society adopts exactly the opposite view when it comes to federal student loan borrowers. A college degree is still basically a prereq for success, and so we have set up a system where people can get student loans through the government to help them access those degrees. (Not saying the choice to use loans as the access tool was good or bad, just observing it’s what we use.) We also have certain protections to help people when they struggle with that loan system.

But if you use federal student loans or IDR, you are essentially supposed to be very sorry for having done so. To bring back de Tocqueville, you have, the view seems to be, slighted (or really, taken from) all of us. Hence things like taxes on the reasonable use of a benefit created in the law (that is, IDR), wage garnishment that recently restarted for federal student loan borrowers who are in default, etc.

Ok, enough about ideology. We have ground to cover on the best stories from the past week regarding debt and its consequences for all of us. Those are below!

So without further ado . . .

This Week In Debt for 1/12/2026:

Vought caves, request funding for the Consumer Financial Protection Bureau.

Lol.

As we discussed last week, this story is about CFPB acting director Russ Vought taking up the dubious legal argument that the CFPB’s funding mechanism is illegal, then losing. There was (I mean, I asked) a question of how Vought would respond, and it seems he’s taking the high road. For now.

Elsewhere, it still matters that the Bureau has been dismantled: The Government’s Annual Student Loan Report Required by Law Never Came Out, CFPB under pressure as consumer complaints pile up.

Trump calls for a 10 percent cap on credit card interest rates. He announced this via a post on Truth Social. I think the following framing from Bloomberg is important (emphasis added):

Banks have long argued unsecured card debt needs a high rate because of the inability to cushion losses when borrowers default . . .

But since [the Financial Crisis], card lending has become highly lucrative. In 2024, JPMorgan said the net yield on its more than $200 billion in card loans was 9.73%. That drove the bulk of the $25.5 billion of revenue for its card services and auto unit, though the bank also had about $7 billion of charge-offs tied to cards.

And more generally, credit card lending basically offers banks the highest return “by far” of any of their products. The margins are huge.

There was a lot of back and forth online re: whether Trump’s edict for a 10 percent cap is good/bad/legal. Eh. I thought the most interesting thing was the banking industry’s wimpy response (emphasis added):

We share the president’s goal of helping Americans access more affordable credit. At the same time, evidence shows that a 10% interest rate cap would reduce credit availability and be devastating for millions of American families and small business owners who rely on and value their credit cards, the very consumers this proposal intends to help. If enacted, this cap would only drive consumers toward less regulated, more costly alternatives. We look forward to working with the administration to ensure Americans have access to the credit they need.

That is . . . a very cordial and sheepish set of words from an industry that otherwise likes to talk tough. E.g., compare the above with this statement from the American Bankers Association regarding legislation introduced last year to cap credit card APRs at 10 percent (that is, to do literally the same thing that Trump claims he is doing; emphasis added below):

This would have a devastating effect on access to credit for individuals and small business owners who rely on seamless access to liquid credit lines. Study after study has shown that even modest government price controls raise costs rather than lowering them. Massive government intervention dictating the terms of a highly popular unsecured credit product would restrict or outright eliminate the availability of this type of short-term revolving line of credit for millions of Americans.

Tough until they aren’t!

Elsewhere: JPMorgan Chase Reaches Deal to Take Over Apple Credit Card, (on this Substack) Mike Pierce: Even Trump’s Own Wall Street Watchdog Admits Working People are Getting Slammed By Credit Card Interest and Fees, (here and at the Vanderbilt Policy Accelerator) Brian Shearer: Take-Down of the Take-Down: The Bankers are Wrong About Interest Rate Caps

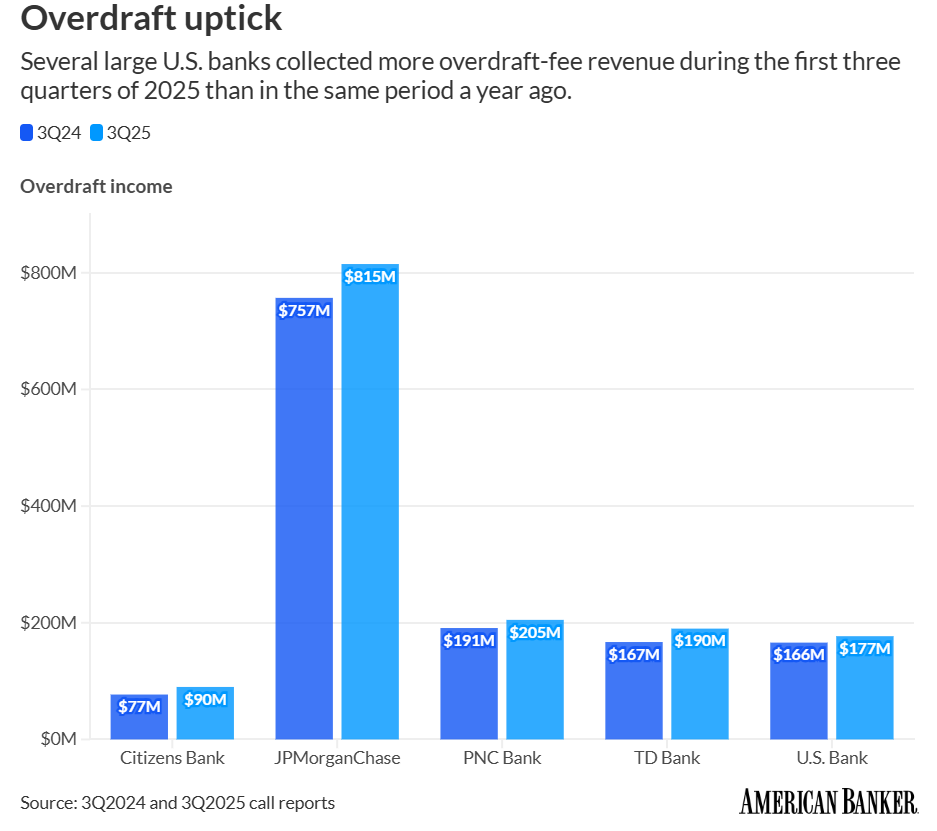

Bank revenue from overdrafts is rising, reaches $3 billion for the 20 biggest U.S. banks in the first 3/4 of 2025. Via American Banker:

Some takes I saw on this (emphasis added):

Melanie D’Arrigo: “To be clear, those banks took over $3 billion from people who had no money.”

Aaron Klein: “This is down sharply from 2019 due to changes most big banks made reducing overdraft. Every bank and credit union could do the same if they wanted to….”

Rep. Mark Pocan: “We banned overdraft fees. Trump brought them back.” (I figure he’s talking about the rule that the CFPB promulgated in 2024 to rein in overdrafts. The Trumps killed it.)

But elsewhere, in better high-cost lending news: Baltimore sues fintech Dave over cash advance product. Recall they also sued MoneyLion in October.

Still, elsewhere elsewhere: the House may mark up a very bad bill that seeks to preempt states from regulating earned wage access products.

Back to student loans. From Protect Borrowers: New Analysis Finds That a Student Loan Borrower Defaulted Every Nine Seconds in 2025, as Trump Restarts Wage Garnishment:

Throughout the first year of the Trump Administration, more than 3.6 million new student loan borrowers have fallen into default—a new default every 9 seconds. This startling estimate, based on new government data, marks an unprecedented default crisis nearly three times worse than the year prior to the COVID-19 pandemic, when over 1 million borrowers defaulted on a student loan—then equivalent to a new default every 26 seconds.

Meanwhile, in news on how the other half borrows: apparently loans backed by art are seeing rising defaults (emphasis added):

Half of non-bank art lenders experienced loan defaults in 2024, up from 17 percent two years earlier, according to the Art and Finance Report 2025, published by Deloitte Private and ArtTactic.

. . .

Regardless of this, the market for art-backed loans is reportedly growing. Deloitte and ArtTactic estimate it was worth between $33.9 billion and $40 billion in 2025, up nearly 12 percent from their last estimate in 2023. The firms predict it could hit up to $50.1 billion by 2027.

There is a big fight happening about “stablecoin yields.”

Basically, the Senate has been trying to pass a so-called “crypto market structure bill” (the CLARITY Act), which would “clarify the Securities and Exchange Commission’s and Commodities Futures Trading Commission’s roles in regulating cryptocurrencies,” among other things.

But there has been a sticking point. The GENIUS Act, which became law last year and more or less created a regulatory framework for stablecoins, does not allow stablecoin issuers to pay interest to coin holders. That restrictions exists to separate stablecoins from bank deposits, noting that critics (e.g., me) argue that stablecoins are effectively just uninsured bank deposits.

In response, stablecoin issuers have started issuing things to coin holders called “rewards.” These “rewards” are payments that exactly mirror interest payments. The key difference between “rewards” and “interest” is that . . . I mean, it’s really just that the issuers call them rewards. (A theme on this Substack! Companies deceptively renaming things!)

So now bank lobbyists want Congress to end the rewards/interest game in the crypto infra bill. Unfortunately for them, the White House is siding with the crypto people. E.g., here is someone who works in the White House :

I mean, if you think policy changes that support the growth of a massive, uninsured shadow banking system are bad, then allowing for “rewards” is bad.

Over at Bits about Money, Patrick McKenzie has a great piece about Zelle and the Electronic Funds Transfer Act. Basically, EFTA creates an actually pretty solid consumer protection regime in the payments space, but the banks have sort of decided they aren’t going to comply with it when it comes to Zelle (the Venmo competitor that they own) because doing so would be lame and not fun (and, more seriously, expensive).

The issue here concerns how the banks handle payments on Zelle that are connected to fraud, noting that such payments appear to be widespread on the app. With other payment tools, like credit cards, EFTA creates a “waterfall” of liability for charges that users challenge as fraudulent. Under that waterfall, a card company would refund a charge that the user challenges, and then the card company would go and ask for that money back from the merchant.

Zelle does peer to peer payments, so there is no merchant at issue per se when someone sends someone else money on the platform, and so there is no waterfall. (Zelle sticks to delivering the payments it’s used to.) In turn, that means the banks that own Zelle are the ones on the hook for refunding fraud that happens on the app. But that would cost the banks money, so they more or less unilaterally decided that that responsibility doesn’t exist.

McKenzie explains (emphasis below in the original!):

Zelle is quick to point out that only 0.02% of transactions over it have fraud reported . . . . Splendid, then do the banks want to absorb on the order of $240 million a year in losses from fraudulent use of a technology they built into their own apps which is indisputably by any intellectually serious person an electronic funds access device?

Frequently in the last few years, the bank has said “Well, as Gen Z would say, that sounds like a bit of a skill issue.” And Reg E? “We never heard of it. Caveat emptor.”

. . .

Why do banks aggressively look for reasons to deny [fraud] claims? Elementary: there is no waterfall for Zelle. If there is a reimbursement for the user, it has to come from the bank’s balance sheet.

The point that McKenzie gets to is basically (summarizing here) that as much as the banks might not want to be the ones on the hook for fraud on Zelle, the thing they want is just not the policy regime we actually live under. (Of course, as McKenzie describes, the Biden-era CFPB sued to fix this, and the Trump 2.0-era CFPB walked away.)

But here we are.

More bank deregulation is coming. Keep an eye out for the “Main Street Capital Access Act.” Hint: it’s not actually very Main Street.

Highlights include:

Raising the threshold for enhanced regulation from $250bn in assets to $370bn (finally, as we were just discussing in this Ohio diner, relief for banks with a quarter of a trillion dollars in assets); and

Barring agencies from even considering if a bank merger resulting in a bank with $10bn or less in assets could “result in a monopoly.”

And finally, some potpourri:

Trump says he wants government to buy $200 billion in mortgage bonds in a push to bring down mortgage rates. Idk, the consensus seems to be that Fannie and Freddie don’t actually have $200 billion? And wouldn’t the Fed just neutralize this anyway? And isn’t $200 billion not even that large, noting that the Fed has a portfolio of about ten times that much on MBS? Idk, we’ll see!

Fresh off his success going after Comey criminally for allegedly lying to Congress, Trump goes after Powell criminally for allegedly lying to Congress. Powell responds.

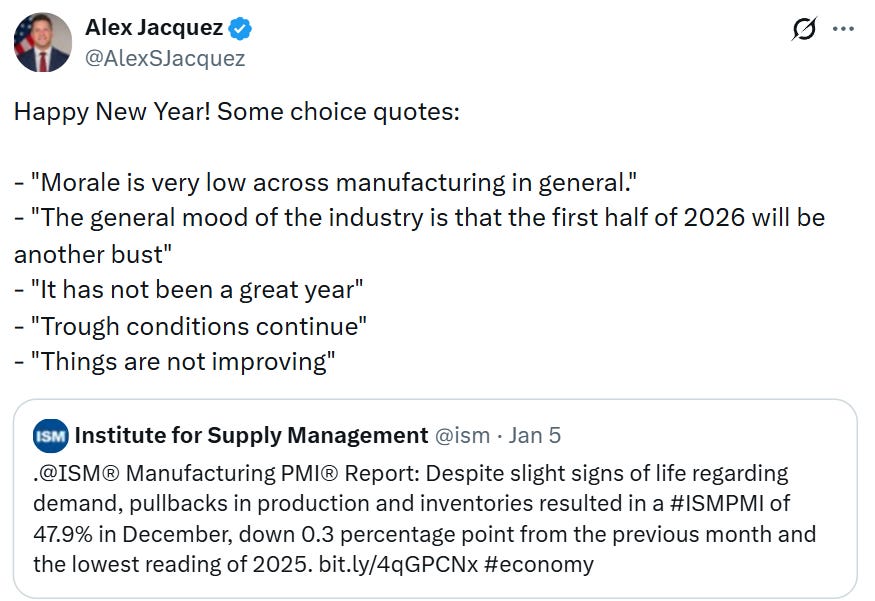

Groundwork’s Alex Jacquez summarizes the ISM Manufacturing Report:

IBEW reports on how Trump’s project cancellations have killed at least 225,000 union construction jobs.

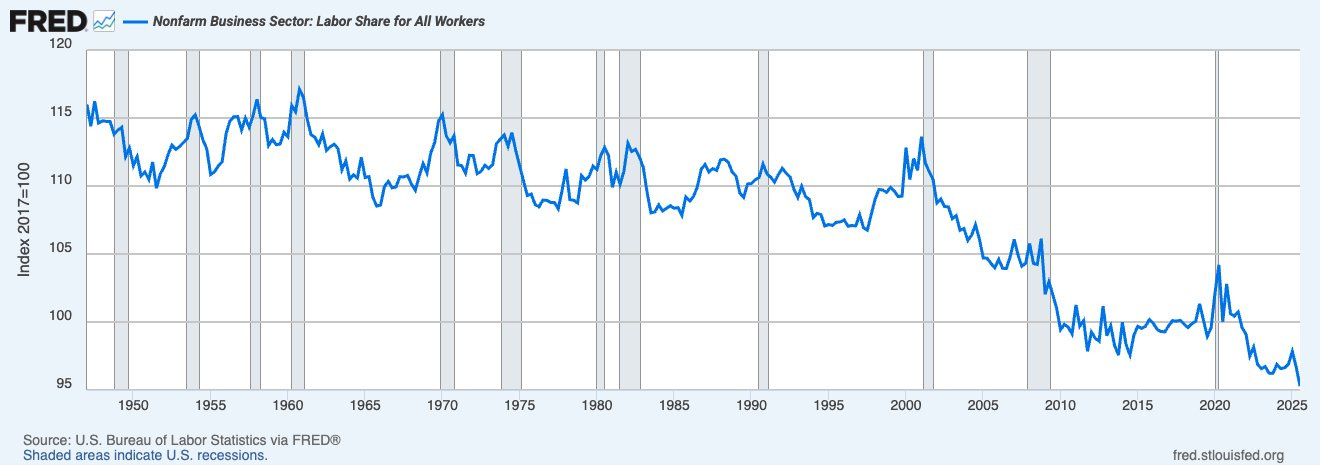

Labor’s share of income for Q3 2025 is the lowest on record (h/t Mike Konczal).

Elsewhere: Growth in non-farm payrolls stalls.

SCOTUS will reconsider the FCC’s monetary penalty powers (not good!)

NYT: Supreme Court Increasingly Favors the Rich, Economists Say (emphasis added):

The study showed a growing partisan divide between the justices. In 1953, the study’s authors wrote, “Democratic and Republican appointees are statistically indistinguishable, deciding on average about 45 percent of the cases in favor of the rich.” By 2022, they wrote, “that share is about 70 percent for the average Republican justice and 35 percent for the average Democratic justice.”

“Put another way,” they added, “the Republican appointees have become more pro-rich at roughly twice the rate that Democrat appointees have become more pro-poor.”

Corporation for Public Broadcasting Votes to Dissolve Itself.

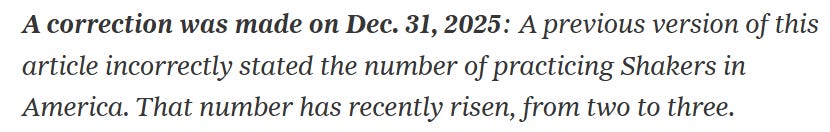

Number of practicing Shakers in the U.S. rises 50 percent:

Nvidia CEO Says He Doesn’t Care About California’s Proposed Billionaire Tax.

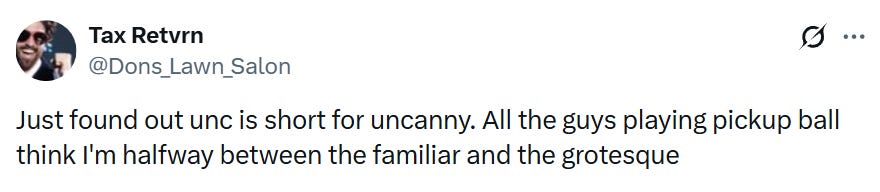

Unc:

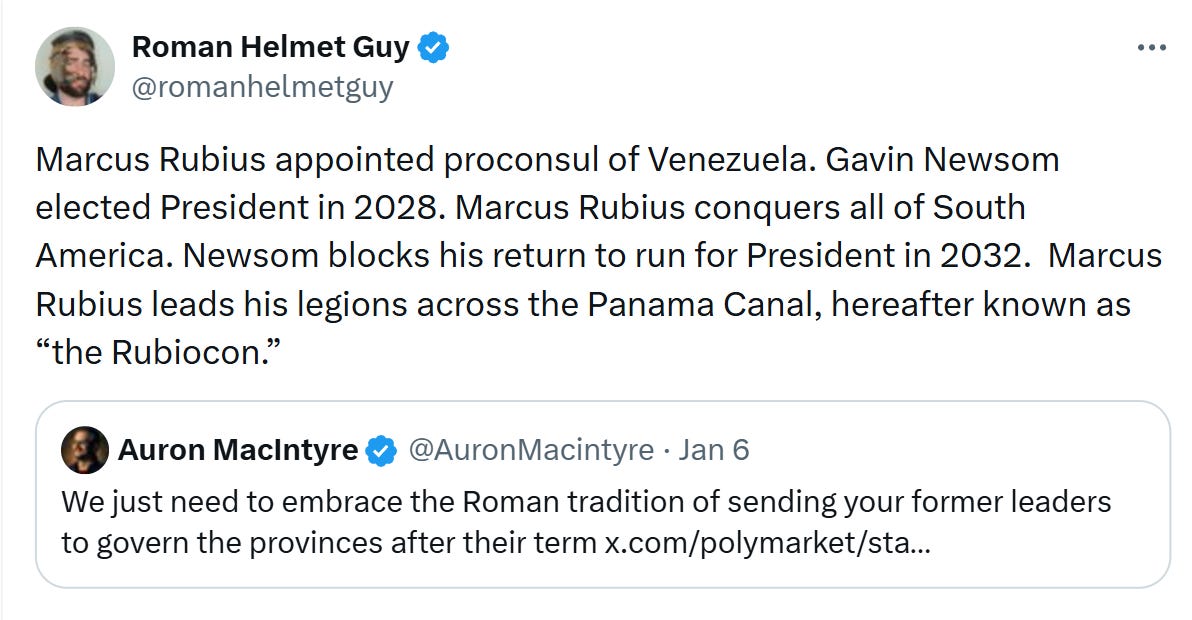

Trump says the U.S. government may reimburse oil companies for rebuilding Venezuela’s infrastructure. Elsewhere: Exxon calls Venezuela “uninvestable.”

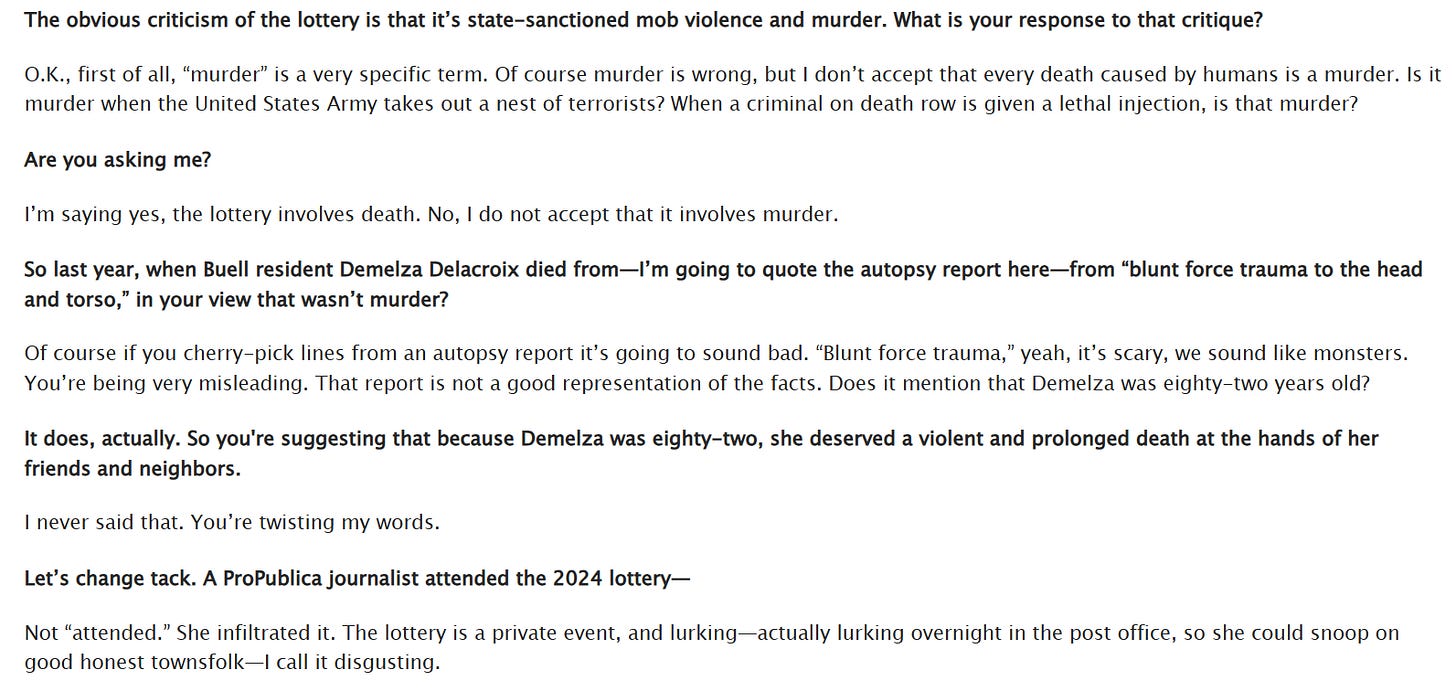

Incredible: Isaac Chotiner interviews the guy who runs The Lottery in Shirley Jackson’s short story “The Lottery.”

WSJ: Why 20-Somethings Are Trading Their Vapes for Cigarettes.

Dr. Oz on revised alcohol guidelines: “don’t have it for breakfast.”

Rest easy, Bobby.

Have a great week!