This Week In Debt: 12/1/2025

Here's how prudential regulation works. (Also: gambling, utilities, DOGE, RealPage, etc)

Hi,

Ok, here’s how prudential/”safety and soundness” regulation works, so that I can arrive at a take on it. (NB: I will be summarizing and simplifying oh such much!)

Banks take money and turn it into loans. To fund those loans, they use a combination of a) money that is more or less debt that the bank will have to repay, and b) money that is more or less investments people made in the bank, which the bank is not really expected to pay back per se. (There’s also lots of stuff that is sort of in between, but ignore that for now; also yes I know what dividends/buybacks are.) Deposits are on the debt side. Call the debts the banks take on “liabilities,” and the investments people made in the bank “equity.” The loans the bank itself makes with those funds are its assets. Here’s a graphic I found on Google, and notice that the two sides (assets and liabilities+equity) balance:

The issue is that the amount of debt-like stuff that a bank borrowed is fixed in dollar terms, while the value of the equity people invested into the bank can go up and down (summarizing! summarizing!). So say the bank has assets of $100, equity of $20, and liabilities of $80. Then something happens—e.g., some of the loans go bad—and the bank’s assets are suddenly worth only $90. Well, the loans the bank owes (those liabilities) are still $80. So that $10 loss on the asset side of the balance sheet has to come out of equity for the two sides to balance. Suddenly, instead of $20 of equity, you have $10 ($20-$10).

And if the value of the assets keeps going down and equity goes below zero, the bank is bankrupt. Oops!

The tension here is that while banks also (I think?) do not want to go bankrupt, they want to fund their operations with relatively more debt, because doing so raises the return on their equity (yeah yeah yeah among other reasons). Think about it like a mortgage: if you have a $100 house with an $80 mortgage and $20 of equity, and the house goes up to being worth $110, the equity is now worth $30 ($110-$80), and your equity has gone up 50% (from $20). That’s nice. But if you have a $100 house with a $95 mortgage (much more debt!) and $5 of equity (much less equity!), and the house goes up to being worth $110, the equity is now worth $15 ($110-$95), and your equity has gone up 200%. 200% is much more than 50%. So that’s even nicer.

But this trick also works in reverse. If you fund a $100 house with $80 of debt, your house has to lose 20% of its value ($20) before your loans is underwater. If you fund the same house with $95 of debt, your house has to lose only 5% of its value ($5) before the loans is underwater. For lots of reasons, banks seem to focus more on the “let’s amplify the upside with debt” part than on the “let’s notice how we’ve amplified the downside with debt” part, with consequences for all of us.

To deal with this tension, regulators basically tell banks “you have to fund your assets with at least a certain percent of your money coming from investments/equity, not from debt.” And last week, federal regulators basically made some of those percentages smaller, meaning that large banks can now have less of a cushion of equity to protect them from insolvency:

The FDIC estimates that these new changes would reduce certain capital requirements by 28% on average at the depository subsidiaries of the biggest banks. More concretely, folks have estimated that the change could take about $200 billion of equity cushioning out of the system.

The agencies defended the move on the grounds that it would make it possible for big banks to buy more low-risk stuff like Treasuries. (Remember what we said above: debt can juice returns, so using more debt can make it it more attractive to buy stuff that would otherwise be low-return). But as UMich Law prof Jeremy Kress points out on Twitter, those banks could also just respond by paying themselves their now-excess cash via buybacks and dividends. He also notes that, even if the banks did go buy “safe” assets, those assets recently “helped cause the second, third, and fourth largest bank failures in U.S. history” (i.e., First Republic, SVB, and Signature; remember them?), so it’s not clear what we’re doing here.

I guess my own take on this is just . . . there is a lot of talk about how Trumpism traces back to discontent that arose from the financial crisis (e.g., here’s Steve Bannon on Michael Lewis’s podcast last week). But then the Trumps appear dead-set on generating a new one. Maybe the Trumps have concluded that financial crises lead to support for Trumpism, and are therefore desirable? Or maybe, just maybe, these moves are a dumb and risky grab-bag of giveaways for the kind of folks who get invited to White House dinners? Idk, I report, you decide!

Now: onto the best of the internet this week on the topic of debt. What wonders it holds!

So without further ado . . .

This Week In Debt: 12/1/2025

I know some tech people read this, so I must start with how the Trumps have shut down DOGE 8 months early.

After Elon promised $2 trillion in savings, it is estimated that DOGE cost about $22 billion outright, could cost taxpayers $500 billion per year in lost revenue, and eliminated tens of billions of dollars in economic activity. Federal spending is rising, and DOGE also probably killed a lot of kids. Meanwhile, DOGE didn’t even manage to reach its main goal: getting Elon to feel like people like him.

DOJ settled with RealPage in a case alleging massive antitrust violations by the rental platform. There is a good thread on the settlement provisions here. People feel the settlement was weak. E.g., David Dayen:

The settlement superficially adds restrictions to RealPage’s use of nonpublic information to raise prices. But . . . this is the bank robber promising not to do it again, rather than returning the loot. And RealPage has already explored new horizons in creative price-setting maneuvers. In fact, RealPage’s attorney said that the settlement “bless[es] the legality of RealPage’s prior and planned product changes.”

Elsewhere: RealPage sues New York over new law banning rent-setting algorithms

How’s online sports gambling going?

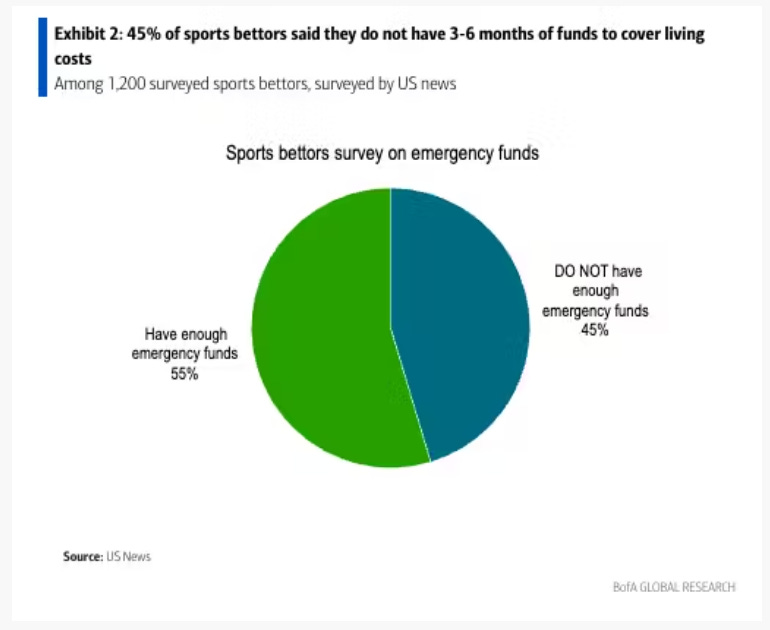

The boom in sports gambling and prediction markets is creating “emerging credit risks,” per Bank of America (emphasis added):

“Easy access and gamified interfaces encourage frequent and impulsive wagers, which can lead to overextension of credit and rising loan defaults,” wrote a team of analysts led by Mihir Bhatia. “For investors this convergence of entertainment and speculative finance signals heightened behavioral risk that could pressure credit quality, increase delinquencies, and impact earnings for issuers and subprime lenders.”

This (potato quality, sorry) graph says that 45% of sports betters say they do not have 3 to 6 months of funds to cover living costs:

Seems bad!

Polymarket Secures CFTC Approval for Regulated U.S. Return (emphasis added):

Polymarket received an Amended Order of Designation from the U.S. Commodity Futures Trading Commission (CFTC), clearing the way for the prediction-market platform to operate as a fully regulated U.S. platform.

The approval, granted Monday and announced Tuesday, allows Polymarket to offer intermediated access in the U.S., meaning bettors will be able to participate through futures commission merchants and traditional brokerage channels.

Kalshi Hit With Nationwide Class Action Over ‘Illegal Sports Betting’. From the complaint:

Defendant Kalshi owns and operates an online and app-based platform that it markets as a “prediction market.” In actuality, however, Kalshi operates an unlicensed sports gambling platform, which is accessible to any resident of the United States who is over the age of 18. By operating unlicensed sports betting, Defendant has violated gambling laws, engaged in illegal deceptive activity, and unjustly enriched itself at the expense of millions of consumers. Accordingly, Plaintiffs, on behalf of themselves and a Class of similarly situated individuals, bring this lawsuit to recover their wagers, as well as costs and attorneys’ fees.

On Twitter, Robinson College law prof. Todd Phillips notes that for Kalshi to assert as a defense that federal regulators said they could do it, “the CFTC would have to weigh in on whether these contracts are (1) swaps that (2) are permissibly listed pursuant to 17 cfr 40.11, neither of which it has done so far.” So basically keep your eyes on this.

Newsweek has a good compendium of data sources that all point to the same conclusion: Millions of Americans Are Defaulting on Loans. From that (emphasis added):

“Credit card balances alone jumped $24 billion, reaching an all-time high, while the share of balances in serious delinquency—90 days past due—climbed to a nearly financial-crash level of 7.1 percent.”

Auto loans tell a similar story, with serious delinquency rates at 3 percent, the highest since 2010. And a spike in resulting defaults has triggered a wave of repossessions in 2025, with 2.2 million vehicles already repossessed, per figures from the Recovery Database Network (RDN), and forecasts of a record 3 million by year’s end.

. . .

Student loan delinquencies, . . . . surged to 14.3 percent in the third quarter from only 0.8 percent in the fourth quarter of last year. . . 5.5 million student borrowers are in default on their loans, with another 3.7 million over 270 days delinquent.

WaPo offers a dispatch from the heartland: democracy isn’t the only thing dealing with issues around darkness (emphasis added):

Soaring electricity prices are triggering a wave of power shutoffs nationwide, leaving more Americans in the dark as unpaid bills pile up. Although there is no national count of electricity shutoffs, data from select utilities in 11 states show that disconnections have risen in at least eight of them since last year, according to figures compiled by The Washington Post and the National Energy Assistance Directors Association (NEADA). In some areas, such as New York City, the surge has been dramatic — with residential shutoffs in August up fivefold from a year ago, utility filings show.

In Pennsylvania, where Pellew lives, power shutoffs have risen 21 percent this year, with more than 270,000 households losing electricity, according to state data through October. The average electricity bill in the state, meanwhile, has risen 13 percent from a year ago, as utilities upgrade electric grids to accommodate a burst of new data centers, according to an analysis of federal data by NEADA, which represents state directors of energy aid programs for low-income families.

The Labor Department began taking control of federal career, technical and adult education money as part of a pact this spring with the [Department of Education] that was intended to centralize and streamline government workforce programs.

Critics say a combination of technical problems, communication lapses, bureaucratic hurdles and scant preparation related to new grant payment systems snarled the process of distributing money from a $1.4 billion program for career and technical education initiatives for schools and local governments. The record-breaking government shutdown didn’t help, either.

Elsewhere:

“Advocates for children with disabilities — and even some Republican lawmakers — are warning that the federal government needs to preserve its special education programs as the Trump administration moves to dismantle the Education Department.”

Education department says some nursing, other degrees not ‘professional,’ limits loans

And finally, here’s some potpourri:

Dengism with Floridian characteristics: $10 Billion and Counting: Trump Administration Snaps Up Stakes in Private Firms

NYT: Meet the Millionaire Masters of Early Decision at Colleges

BBerg: Private equity firms flood junk debt market to pay themselves

NYT Ed Board: Trump Falls Short of His Populist Rhetoric (o rly?)

WSJ: The Fed’s Tool for Calming Short-Term Funding Markets Is Being Tested

NYT: The Federalist Society Is Torn Between Its Legal Philosophy and Trump’s Demands

Meta halted internal research suggesting social media harm, court filing alleges

Looks Like Trump Will Get the New Rush Hour Movie He Asked For

Have a great week!