This Week In Debt: 12/22/2025

It’s a showroom for digital experiences. It’s a community gathering place.

Morning,

It’s the end of the year, so let’s lighten things up this week before we get to the news.

I often say critical things about banks on this Substack. E.g., I routinely call them “whiny.” But today, in lieu of an opening take, I have a confession to make: I love the Capital One Cafe (C1C).

For those who don’t know (or who are not fortunate enough to live near one of the 60+ C1C locations “in 21 of the top 25” metro areas in the U.S.), Capital One, the sixth largest bank in America, also owns a chain of cafes. No, these are not bank branches that happen to serve coffee. They are cafes. The C1C website helpfully explains that you don’t have to be a member to visit, that they will not try to sell you things while there, and that they do, in fact, serve food. The cafes just happen to be owned by Capital One. Which, I reiterate, is the sixth largest bank in the U.S. You may think I’m kidding.

An article from an NBC affiliate in Austin explains that the C1C got its start in 2009, when the online bank ING Direct opened a line of “cafes” instead of “branches.” C1 bought ING in 2012, and it (wisely!) chose to invest in the cafes instead of dumping them.

This all may help explain why former Fed Chair Paul Volcker famously said in 2009 that, “The only thing useful banks have invented in 20 years is the ATM.” He had not yet seen the cafe.

Now sure, you could think I like the C1C because it is a dumb, funny piece of flotsam in the consumer finance world. You could think I like it because it’s fun to imagine the C1C’s possible peers (the Bank of America Bodega, the PNC Pub, the BMO Bistro, etc—and in fact Chase, Santander, and Scotiabank appear to be opening their own cafes). You could think I like it because I am a Millennial, and I still get my jollies from cringey ironic detachment.

And yeah, that’s all correct. But also I sincerely submit to you that the place is actually good. Like, you get half off coffee if you have a C1 card, the coffee is usually from Verve (so, like, it is in fact fine), the food is reasonably good, there’s wifi, there’s outlets, and it’s otherwise a much nicer environment than you might expect in which to like, idk, post up and do homework! They also do a bunch of deals, e.g. free coffee every Monday during baseball season. And it’s a great place to stop by the bathroom if you’re traveling (shoutout to the C1C in Boulder!). I dig it!

Not everyone is impressed. E.g., Ali Breland of The Atlantic said this in Mother Jones in 2022:

It can be hard to literalize how financialized capital has overtaken our lives. I figured coming to [a?] Capital One Café might help. The existence of which offers, if not a simulacrum, an indicative example: It is not enough for an average chain coffee shop to exist—it must also be literally vertically integrated into a bank.

Yeah, that’s the sound of my eyes rolling past the back of my head. The article also contains the following (ha hi Farry!):

Capital One Cafés have turned a website into a physical place: “an uncanny disembodiment” in which “digital capitalism seeks to render the consumer’s body superfluous.”

Well if my body has been rendered so superfluous then why am I putting all this sweet sweet Capital One coffee into it???? (I sincerely do not know what that quote means!!!!)

Also, adding to my admiration for it, the C1C appears to be losing money for the bank. I’m saying that based only on how the company talks about it (their financials don’t really break it out, yes I looked). E.g., at a conference in 2023, C1’s SVP for Global Finance said (emphasis added):

I can’t emphasize enough that a cafe is way different than a branch. So you don’t really measure the success of a cafe by sort of product sales and throughput. It’s a carrier of the brand. It’s a showroom for digital experiences. It’s a community gathering place.

First of all: hell yeah. Second: right, “focus on the effect the cafe has on the brand” is what you say when the cafe doesn’t have a great first-order effect on the money. Third: for the Mother Jones crowd, if C1 loses money on the cafes, is buying coffee there socialist praxis?

Anyway. Maybe the real lesson here is a hope for more whimsy in 2026. Maybe it’s an aspiration that we can continue to find the good in each other, despite our past misdeeds (looking at you, Capital One). And maybe it’s a call for all of us to be just a bit more welcoming to each other next year—say, like the good ol’ Capital One Cafe.

And now we have arrived at the main event. Below, I give you the best of the past week in debt and its consequences for society. Happy New Year, and see you in 2026!

So without further ado . . .

This Week In Debt: 12/22/2025

The full DC Circuit Court of Appeals will take up the case challenging mass firings at the Consumer Financial Protection Bureau.

Recall: The Trumps basically tried to fire everyone at the CFPB. Then NTEU, the union that represents those employees, sued to block that action on the (obviously correct) grounds that the Trumps were attempting to engineer a de facto shutdown of the agency. NTEU won an injunction at the district court level, but a three-judge panel on the DC Circuit Court of Appeals reversed. Now, the rest of the Court of Appeals (which is decidedly more liberal than the tree-judge panel) has agreed to hear the case. This is called an “en banc” hearing. Oral argument is scheduled for February. Mark your calendars.

(Disclosure of a personal conflict: I have a very cool t-shirt from NTEU)

Powerful new stuff from the California Policy Lab (some emphasis added below) on how everything in student loan land is just so bad, and is also about to get worse:

Key findings:

Two out of three student loans are not being actively repaid. That’s partly due to a recent surge in the use of administrative forbearance while court cases are pending.

The share of loans in deferment or forbearance has more than doubled since mid-2023 and now stands at 49%.

Of student loans requiring a payment, a full 25% are behind on payments.

A proposed settlement announced yesterday will require 7.7 million borrowers to restart payments. If those borrowers are delinquent at the same rate, nearly 2 million more borrowers will be late on payments.

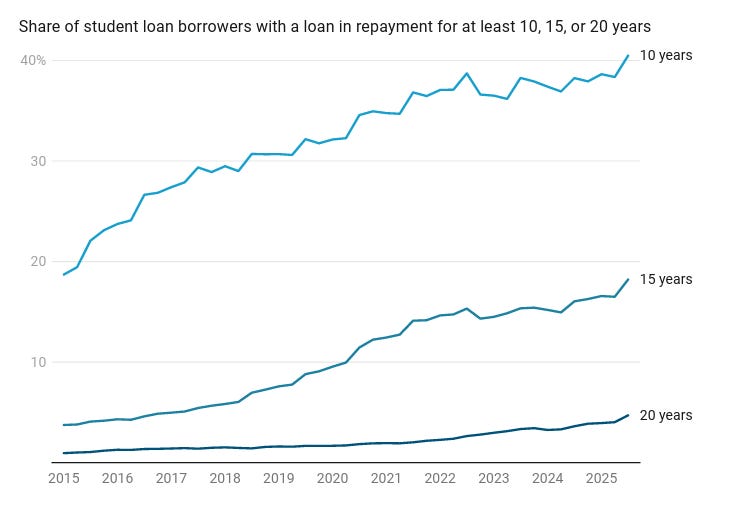

The share of borrowers that have been repaying their loans for more than 10 years has doubled from a decade ago (from 22% to 40%).

Truly, what are we doing here?

Oof (emphasis added below):

A growing number of pet owners in Massachusetts and across the nation are struggling to afford health care for their dogs, cats and birds amid increasing costs and tightening budgets. These debts are often placed on credit cards, and may be set aside as other bills take precedence, veterinarians and pet advocates say.

. . .

Some 22% of pet owners carry more than $2,000 in pet-related debt, according to arecent report by MetLife Pet Insurance. About one in seven pet owners experience what is known as “pet poverty” — a situation where they can’t meet both their basic needs and those of a companion animal, the report said.

. . .

Defendants have been sued for as little as $300 to more than $5,000 [in pet debt], court records show. The number of such lawsuits has jumped in recent years — with the last three years of lawsuits more than double the total of the three years before.

Public comments closed last week on the CFPB’s “radical” effort to gut the Equal Credit Opportunity Act (ECOA). In an illustration of the glory of American participatory democracy, there are more than 40,000 comments on the docket. The comment from the NAACP LDF does a good job summarizing what the Bureau is trying to do (emphasis added):

[T]he CFPB now proposes to revise Regulation B, which describes the obligations of banks and other covered lenders under ECOA, to remove protections against unjustified discriminatory policies (disparate impact discrimination); narrow the definition of prohibited “discouragement” to allow discrimination against prospective applicants; and rescind provisions permitting covered lenders from creating Special Purpose Credit Programs (SPCPs) to expand access to credit to underserved borrowers.

I . . did not read the 40k comments, but I poked around for some letters by orgs/industry folks. So in addition to the LDF one above, here are letters from (collecting these as a resource for people):

American Bankers Association, Americans for Financial Reform, Bank Policy Institute, Blue state AGs, California Association of REALTORS, Center for Responsible Lending, Center for Mortgage Access, Consumer Bankers Association, Consumer Fed of America, CPAC Foundation Center for Regulatory Freedom, Electronic Privacy Information Center, Housing Justice Center, Hope Credit Union/Hope Policy Institute/Hope Enterprise Corporation, Independent Community Bankers of America, The Leadership Conference on Civil and Human Rights (joined by 8 other orgs), Mortgage Bankers Association, National Association of Mortgage Brokers, National Association of Consumer Advocates, National Association of Realtors, National Automobile Dealers Association & National Association of Minority Automobile Dealers, National Consumer Law Center, Online Lenders Alliance, and Tzedek DC.

The lefty groups say what you think they’ll say, and I agree with them, so I won’t go into detail.

Most of the industry groups supported the proposed rule, and here’s a flavor of what those in favor of it said (this is from the Independent Community Bankers of America, though lol yeah every letter supporting the proposed rule began with a disclaimer about how the letter-writer and the companies it represents hate discrimination) (emphasis added):

Community banks are committed to eliminating illegal discrimination in lending and to ensuring that the credit needs of their communities are met on fair terms, regardless of an applicant’s race, color, religion, national origin, sex, marital status, or age.

The CFPB’s proposal to amend Reg B with ECOA’s statutory text will reduce regulatory uncertainty and protect community banks from costly litigation. This is particularly important for smaller banks, which face disproportionate costs from complex fair lending rules. The proposal aligns with Executive Orders 14173 and 14281, emphasizing merit-based opportunities and eliminating disparate-impact liability where unsupported by law.

Folks, they’re just trying to eliminate uncertainty, stick to the letter of the law, and avoid litigation (hey guys, litigation over what?). Thought I should say that some industry groups, like the National Association of Realtors, were pretty critical of the proposal.

So now the million dollar question: can the Bureau publish a final rule before it runs out of money in “early 2026” under the funding crisis that Trump’s political leadership has imposed on the agency?

Elsewhere: CFPB Allocates $46 Million To Synapse/Evolve Victims In First-Ever Fintech Bailout.

Over at the Vanderbilt Policy Accelerator, former CFPB Chief Tech Officer Erie Meyer has a cool proposal for a centralized complaint system for federal agencies:

In the United States, there are at least 176 different government agencies that accept consumer complaints. Each has its own form, its own jurisdictional quirks, and its own siloed system. Figuring out where to go is like solving a jigsaw puzzle where the picture is described in scattered legislative text spanning hundreds of years.

. . .

My proposal: Complaints.gov

Complaints.gov wouldn’t be a new agency. It’s infrastructure that connects people to the accountability systems we’ve already built and paid for.

Here’s how it would work:

A simple complaint form that routes your issue to the right agency and company for response, no matter where you start. Whether the place that could help you is your state AG, a city consumer protection office, or the investigator general of a federal agency — there’s no wrong door to get to them.

Company responses within 15 days. Companies would have 15 days to engage with your complaint and explain what they’re doing about it.

A public database of complaints (with redactions for privacy), including what happened in the consumer’s own words and how and when the company responded. You could see which companies play by the rules before you hand them your money.

Modern tools for regulators, so even small agencies can spot patterns, collaborate, and act before small harms become nationwide emergencies.

She also has a detailed write-up of the proposal here.

I wrote a while ago about Apollo, “a really big non-bank financial institution that is very, very involved in private credit.” This week, Apollo published a 125-slide presentation that is sort of about a lot of things in private credit, including 1) what private credit is, 2) what it isn’t, 3) why private credit is actually not as systemically risky as people say, 4) where systemic risk actually is (slide 99: the Caymans), and 5) why private credit is already appropriately regulated, thank you very much.

Recall: private credit is more or less “just a name for the part of the financial world where lenders make really big loans to companies and then hold those loans on their balance sheets instead of selling or securitizing them.”

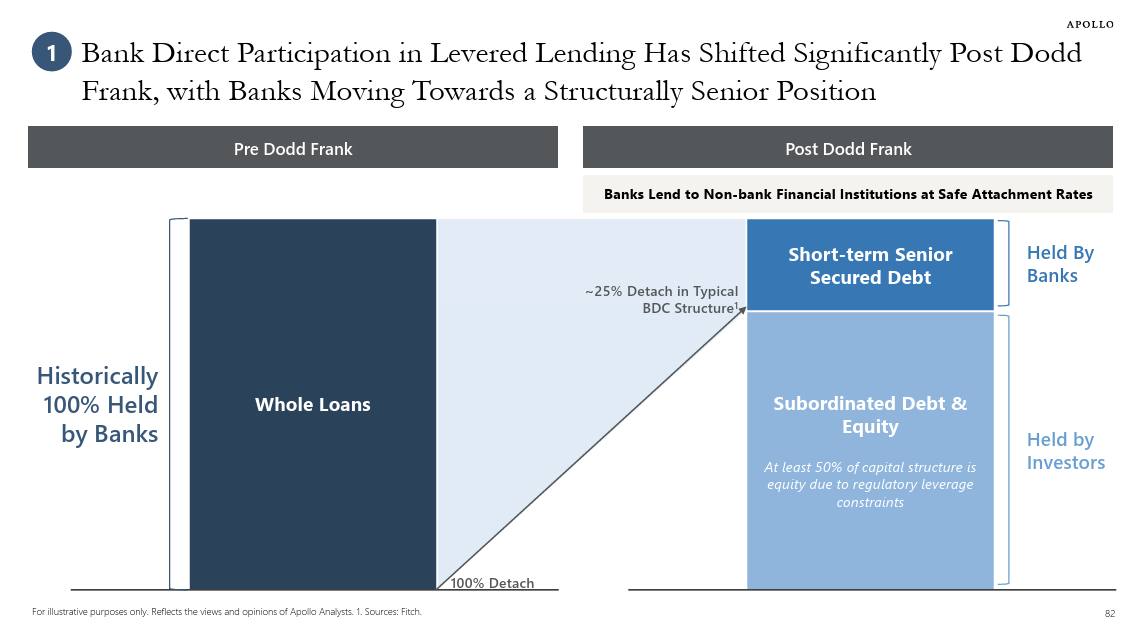

But my takeaway was about banking. See slide 82:

Basically (summarizing throughout this paragraph), what this slide says is that the rise of private credit has involved a lot of the riskiest parts of finance moving out of the banking sector. In particular, before the Financial Crisis, a bank might have made and held an entire loan (ignoring those that it infamously originated to distribute). Now, a bank is more likely to sort of just hold a very senior claim on a given loan, while a private credit investor is exposed to the riskier bits.

There are a lot of reasons to be skeptical of the rise of private credit and worried about its effects on markets, financial stability, the economy, society, etc. But like, the particular thing I just described in that paragraph above seems unambiguously good?

Basically, what this shift means is that the riskiest stuff is moving away from the banking sector’s short-term deposits and toward the long-term funding of the investment sector. In that latter pool, people often can’t just pull out their cash (meaning runs are unlikely), and they go in knowing they can lose on their investment (which is literally the opposite of how bank deposits work). The result is that risk is now more likely to be held in relatively risk-tolerant hands, and that the set of things left in the inherently fragile banking system is less risky! (Noting that banking is inherently fragile because it involves borrowing short-term to lend long, more on that here.)

That all should, in theory, mean fewer crises that require the deployment of the financial system’s safety net (payouts to depositors from the FDIC’s insurance fund, Fed lending to creditors, etc etc etc).

Idk, again, I am no fan of private credit per se. Maybe the pro-consumer way of framing this is as a victory for Dodd-Frank and its goal of making the banking sector safer. But it does seem safer!

Also yeah Matt Levine wrote something about this like a year ago.

And finally, some potpourri:

Just in time for Christmas: US regulator loosens some compliance burdens for Citigroup.

Ska band has a gofundme for debt from its tour. Debt is everywhere! (h/t Jackie Filson)

Romney in NYT: Tax the Rich, Like Me.

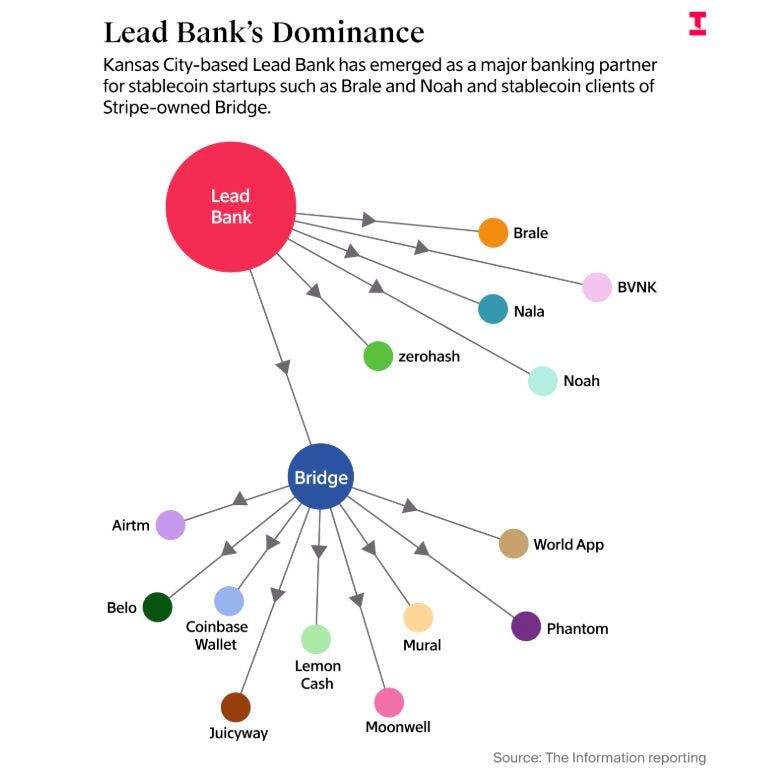

Small Bank Critical to Stablecoin Payments Tightens Risk Controls

Crypto Fraudster Sam Bankman-Fried Has New Pursuit: Jailhouse Lawyer. It’s going badly:

Acting as an informal legal adviser, the prisoner, Sam Bankman-Fried, encouraged Mr. Hernández to testify on his own behalf, Mr. Bankman-Fried said in a Friday interview from prison.

Mr. Hernández had already been inclined to take the stand, and he followed the advice. It went poorly. Days later, he was convicted of conspiring to import more than 400 tons of cocaine into the United States.

Private Equity Finds a New Source of Profit: Volunteer Fire Departments

Trumps defund program for deafblind children over “diversity goals.”

FTC changes its tune on surveillance pricing on the heels of a killer exposé by Groundwork Collaborative, Consumer Reports, and More Perfect Union.

These people are just comically corrupt:

DHS fast-tracked a $1 billion contract to a pro-Trump donor’s company.

Senator Warren on how Trump is selling TikTok to his friends.

Trump says he’s going to direct his DOJ to pay him a $1 billion settlement over a private lawsuit he brought.

Also they’re killing a key atmospheric research center because Trump is mad at the governor of Colorado.

Someone should tell 50 Cent that revealing the existence of a debt to a third party is an FDCPA violation. (I am kidding and this is not legal advice!)

In the Dispatch: The Year America Went (Kinda) Socialist (“Dengism with Floridian characteristics”!)

Jim Beam shutting down bourbon production at Kentucky distillery for a year as Trump’s trade wars hit sales

Natural experiment in VA and NC shows industry’s warnings of the sky falling if VA raised its minimum wage didn’t materialize.

“91.4% of worries experienced by people with anxiety never come true” (but the remaining 8.6% will happen to you).

Mike Konczal: mass deportations “would save renters less than $5 a month.”

Trump claims tariffs brought in $18 trillion (to quote Chris Fleming, this is “a child’s lie”)

Have a great . . . rest of the year!