This Week In Debt: 1/5/26 (CFPB Edition)

That ain't it, chief.

There are decades where nothing happens [in consumer financial services regulation]; and there are weeks where decades happen [in consumer financial services regulation] - Vladimir Lenin

Happy New Year! So much happened over the break that we’re splitting our weekly news wrap into two parts: CFPB stuff today, everything else tomorrow.

Let’s get right to it.

I am not a lawyer and this is not legal advice, but if you’re the Defendant in a case that is sort of about whether you’re trying to dismantle the CFPB, and the judge opens her order with a quote about how you want to dismantle the CFPB, well, idk, that’s not what you want. Sorry, Russ:

If you read this news letter, you probably already saw this story. (If you didn’t, don’t worry, we’ll get there.) But by way of an opening take, I want to reflect on just how embarrassing this order was for the Administration.

To review: what’s going on here is that a federal judge last week shot down the Trump CFPB’s obviously dumb claim that the agency faces a self-imposed funding cliff. The order above concerns a recent memo by the White House Office of Legal Counsel’s (OLC) claiming that the mechanism the CFPB uses to fund itself (that is, getting money from the Fed) is illegal.

The administration’s argument (this could be weedsy, but just hold my hand, and also there’s more detail here if you want it) concerns the language that the Dodd-Frank Act uses to describe exactly where the CFPB gets its funding. In particular, that law says the Bureau’s money comes from the Fed’s “combined earnings,” which essentially everyone has historically taken to mean the Fed’s revenues.

Conservative opponents of the Bureau, however, recently began mounting the argument that “combined earnings” means profits. That distinction matters because the Fed stopped having profits after it raised interest rates post-COVID. If “combined earnings” meant profit, then, there wouldn’t be anything for the Fed to send to the CFPB, and the Bureau would run out of money. Then, the agency would have to effectively shut down (likely in “early 2026”).

That leads us to last week’s ruling, where Judge Amy Berman Jackson basically beat the hell out of that argument and more or less accused the Trumps of bad faith (note the injunction she’s talking about in the quote below is one she entered to block the administration’s attempted mass firings at the CFPB, also emphasis added throughout):

The Court clarifies that the claimed “lapse” in funding, which was manufactured by the defendants based solely on the OLC Memo, is not a valid justification for the agency’s unilateral decision to abandon its obligations under the injunction.

. . .

Neither the statute, the injunction, nor the Fed’s willingness to [fund the CFPB] has changed; the only new circumstance is the administration’s determination to eliminate an agency created by Congress with the stroke of pen, even while the matter is before the Court of Appeals. It appears that defendants’ new understanding of “combined earnings” is an unsupported and transparent attempt to starve the CPFB of funding and yet another attempt to achieve the very end the Court’s injunction was put in place to prevent.

Oof! Jackson also spent the first ~20 pages of the opinion recounting the extensive chicanery, misdirection, and disrespect for court orders the Trumps have engaged in so far in this case. E.g. (cites omitted, emphasis added):

At the outset, it is important to remember that the [injunction] did not arise in a vacuum; the Court determined that the preliminary injunction was necessary to preserve the status quo in light of the defendants’ ongoing hurried efforts . . . to dismantle the CFPB. Indeed, they resumed those efforts by initiating a widespread reduction in force (“RIF”) the instant the Court of Appeals stayed the preliminary injunction. Although that action was exposed and enjoined by this Court, . . . the defendants are actively and unabashedly trying to shut the agency down again, through different means.

Not good!

And if I may, here’s one last thing that I didn’t appreciate regarding how hilariously bad the OLC opinion was until I read the Jackson order: the Trumps struggled to distinguish their newfound definition of “combined earnings” from the phrase people actually do use to describe “income minus expenses” (i.e., net earnings), so they said that “combined earnings” actually means income minus only some magically selected expenses (that is, ones that would be big enough to make the re-defined “combined earnings” negative, so that there would be noting to send the Bureau).

Jackson wasn’t impressed (emphasis added, citation omitted):

The OLC and defendants do not propose that “combined earnings” means all income minus all expenses; they contend that only a certain subset of expenses – interest payments – should be subtracted from the Fed’s income to calculate its “combined earnings.” This cannot be squared with any definition or common understanding of the term; defendants do not point to a single dictionary entry, accounting principle, or business practice that supports this unusual hybrid approach.

Again, oof!

This is all obviously very embarrassing for OLC, and DOJ has already signaled it may not be bought in on this funding argument in the first place. (Plus, the Fed may be back to profitability anyway.)

The big question is what CFPB acting director Russ Vought will do next. Does he try to ask for as little funding as he can without being held in contempt of court? Does he . . . just sit on his hands? Stay tuned. As a starting point for your betting line, the Bureau said it needs $280 million to keep operations going in 2026.

(Also, what does this mean for the fact that the Bureau has recently been using interim final rules to carry out its agenda instead of notice-and-comment rulemaking on the grounds that it’s about to run out of money?)

In the meantime, I have gathered for you the best of the internet from the past two weeks regarding consumer credit and its consequences for all of us. As I said above, the rest of this email is CFPB news, while “everything else” news is coming in hot tomorrow.

So without further ado . . .

This Week In Debt for 1/5/2026, CFPB Edition:

First, Politico reports that small banks are actually unhappy with the CFPB’s ongoing dismantlement! One way to tell the story of the CFPB’s creation is to say that the big banks caused a crisis, and then a combo of consumer advocates and small banks came together to pass the Dodd-Frank Act to rein the big guys in. (This book basically tells that story. Not saying I endorse it! Go believe what you want! God is dead!)

The shape of that coalition had consequences for the nature of post-Crisis regulatory reform. For example, the CFPB has supervisory authority over banks if and only if they have assets over $10 billion. That’s nice for smaller banks, which get to keep their old supervisors (the FDIC, the OCC, etc), noting that those supervisors have historically done such a bad job at consumer protection that Congress had to go create the CFPB.

The flip side, though, is that if someone (e.g., someone named Russ Vought) sabotages the CFPB, then small banks lose the competitive advantage that comes from not being under that agency’s supervisory purview.

And so (emphasis added):

The CFPB writes consumer protection rules for all banks and lenders, but is only in charge of enforcing them for banks with assets greater than $10 billion. For smaller banks, the main regulators — the Office of the Comptroller of the Currency, the Federal Reserve, and the FDIC — are in charge of enforcement. Those regulators continue to enforce consumer protection rules, even as the CFPB winds down, according to the small banks.

. . .

“We are at a severe competitive disadvantage,” said Jack Hopkins, CEO of CorTrust Bank, a community bank based in Sioux Falls, South Dakota. “We are having to allocate resources to the compliance exams, while the big banks are seeing those costs and fines reduced or eliminated. And the non-banks don’t even have the prudentials regulating them,” said Hopkins, who chairs the Independent Community Bankers of America, a trade group.

That disadvantage is real: smaller banks have still been getting knocks on the door from supervisors (even if those supervisors’ ambitions have been rolled back a bunch too), while the CFPB doesn’t seem to have done a single exam of a large bank in almost a year.

I have written here about the Bureau’s open banking rule, which has generally pitted large banks against fintechs and crypto. Here, we see large banks sort of being pitted against small banks. I guess the lesson is that the goal of giving corporate interests massive handouts can be harder to achieve than one might expect, because handouts to one industry can actually hurt another! Oops. I mean, I’m sure they’ll figure out something.

The Bureau reverses course, declares that Earned Wage Access products are NOT loans.

Recall that EWA products are a form of digital payday loan, with the difference from traditional payday loans being that a) they have better websites, and b) they go around saying they aren’t payday loans.

The Bidens put out an interpretive rule in 2024 saying that EWA loans are loans, and that their lenders have to comply with consumer protection laws like the Truth in Lending Act. Now, the Trumps have rescinded that rule and replaced it with one saying that EWA loans are not loans, at least under certain circumstances (i.e., if the loan is a “covered EWA” loan, which has certain requirements).

There is obviously a lot to note here, but I’ll point you to the National Consumer Law Center’s great statement on the move. There, Lauren Saunders says (emphasis added):

Payday loan app lobbyists will undoubtedly try to use this faulty CFPB opinion to promote loopholes in state interest rate laws. . . . States should defend their laws against predatory lending and throw this opinion in the trash.

So now we all have marching orders.

There is also an element here that is, like, if you live by Loper Bright then you die by Loper Bright, you know? (For non-lawyers, that is a joke about how a recent Supreme Court case called Loper Bright basically makes it so that courts ultimately get to decide on regs now instead of agencies doing that, and so a court will probably end up cutting through this flip-flopping anyway.)

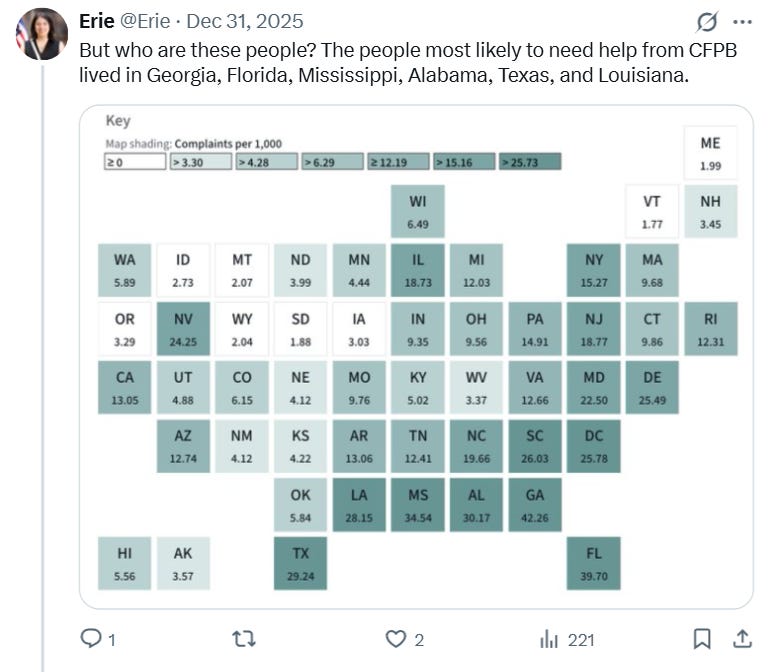

Biden-era CFPB Chief Technology Officer Erie Meyer observes on Twitter that the number of complaints that consumers submitted to the CFPB about companies harming them doubled in 2025. It’s particularly bad in Red states:

And finally, CFPB grab bag:

Nearly 2 dozen states sue the Trump administration over funding for CFPB. (Their case is about the same funding thing as above, and it seeks to require the Bureau to request money from the Fed.)

‘Nonexistent’ CFPB Gives Way to Surge in State Enforcement, Lawyers Say.

Check in tomorrow for the potpourri section!

Have a great day!

The breakdown of how EWA products are basically payday loans with better websites is absolutley brilliant and cuts through all the industry spin. I remmember trying to help a friend understand whether one of these apps was safe and the terms were so confusing compared to traditional credit. Your point about Loper Bright coming back to bite regulators is spot on and shows why courts will probably sort this mess out eventually.