This Week In Debt: 2/16/2026

Private equity caused a font crisis at the CFPB, & more.

Morning,

Today, I have the solemn responsibility of reporting to you that a private equity company has caused a crisis of typefaces at the Consumer Financial Protection Bureau. I am not kidding, and I submit to you that this story is emblematic of everything that is currently wrong with society and the economy.

(For this story, I am indebted to various fellow former CFPBers including but not limited to Whitney Harris.)

In particular: it appears that in July 2025, the CFPB updated the header font on its website “from Avenir Next to Source Sans 3” (SS3). The Bureau has attempted to defend SS3 in the agency’s style guide, saying “With letters that are slender but open, Source Sans 3 has a simple and approachable look.” But like, here is a comparison, and you tell me.

First, the old, elegant, Avenir Next, from a permalink I happened to have:

And now, on the current version of the same page . . . SS3:

Ugh! It’s just bloated and charmless. (I am going to kick some additional discussion of the Bureau’s historic and noble practice of taking design seriously to a footnote.[1])

But of course the interesting thing here is not me having niche interests that include fonts. It’s that this is actually a “private equity making everything worse” story.

The Avenir font family, you see, was first created by a “type foundry” called Linotype in the late 80s. Then, in 2006, a company called Monotype bought Linotype, meaning it bought Avenir. And then—you guessed it—a private equity company bought Monotype in 2019.

Monotype has gone on to buy up most of the competing font foundries, leading people to accuse Monotype of being a “kraken eating up the industry.” One font designer put it this way soon after the 2019 PE buyout (emphasis added):

Monotype has been so successful in the consolidation of the font licensing business that the company has run out of significant acquisitions in its chosen market segment . . . .

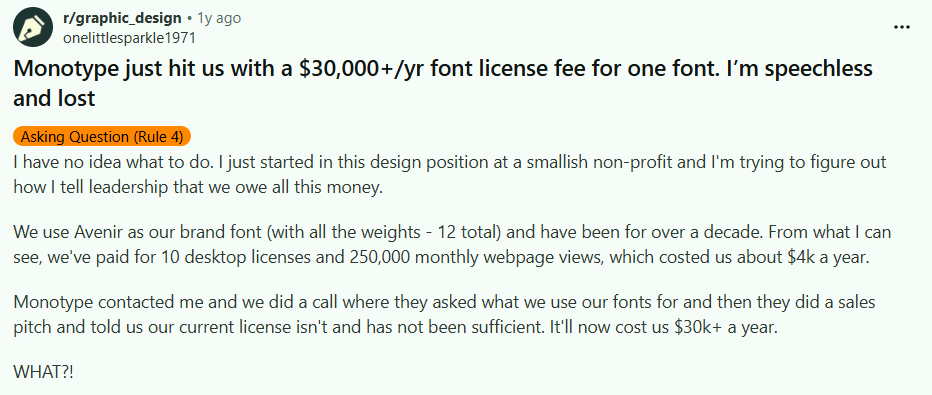

And with market-wide size comes great market power. In particular, it seems that the CFPB and others were able to license Avenir affordably from post-acquisition Monotype for a few years. But then the company began flexing its monopolistic muscle, including by massively increasing the licensing fees that it charges for the use of its fonts at some point in 2025. E.g.:

(They also got caught increasing fees on Japanese video game developers from ~$380 per year to $20,500 per year. In addition, Monotype appears to have suddenly become much more aggressive regarding allegedly unlicensed uses of the company’s fonts.)

I do not have any insider info on the Bureau, but I’d bet my bottom dollar that the fee-hike is what prompted the CFPB’s switch. (The new font is open-source.) And while I also have no insider info on Monotype, I can’t help but wonder whether the company’s increased stinginess starting in 2025 could have to do with the $1.45 billion loan the company took out in 2024 to pay its private equity owners a dividend:

Ughhh.

It feels obligatory to wrap up here with a paragraph about how the private equity industry tends to worsen the world in general and beloved things in particular, and that story has been told before in many places. But like . . . a lot of things we deal with are already shitty, and we are now also going to have shittier typography because a private equity company decided that uglier writing for everyone was the cost of that company enriching itself. The fonts themselves aren’t (I will begrudgingly admit) the most important thing here; it’s more that the list of places where this type of thing is happening has gotten long.

Alright, alright, enough on the fonts. Below, I have graciously provided the best news stories of the week from the world of consumer finance. I hope you find them tasteful and elegant.

So without further ado . . .

This Week In Debt for 2/16/2025

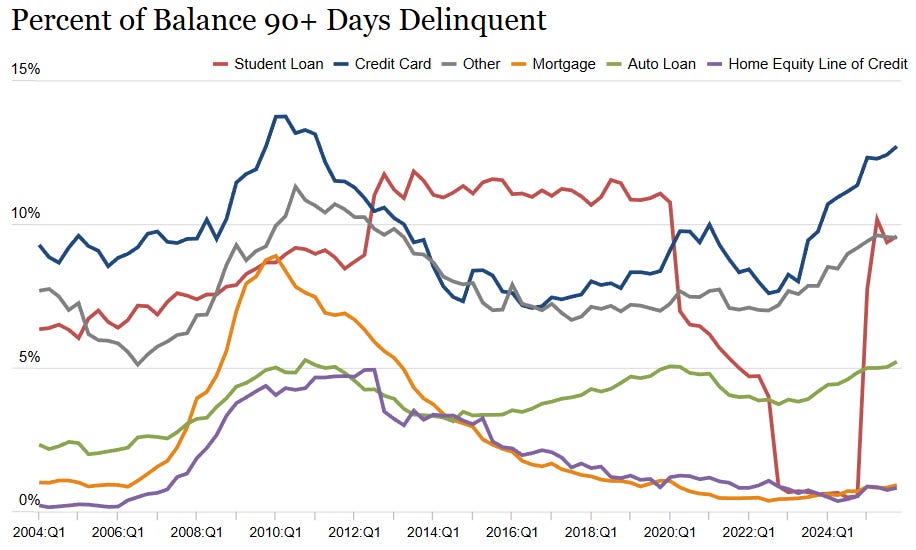

The New York Fed published its quarterly report on conditions in consumer credit market, and it’s looking pretty bleak. Americans owe more than they have at any point in history—$18.8 trillion in total—and Bloomberg reports based on the Fed data that “US Consumer Delinquencies Jump to Highest in Almost a Decade.” From the Fed:

The delinquency rate for just about every kind of loan that isn’t tied to a house is at pre-Great Recession highs, and jeez, look at the blue line for credit cards! Up and to the right.

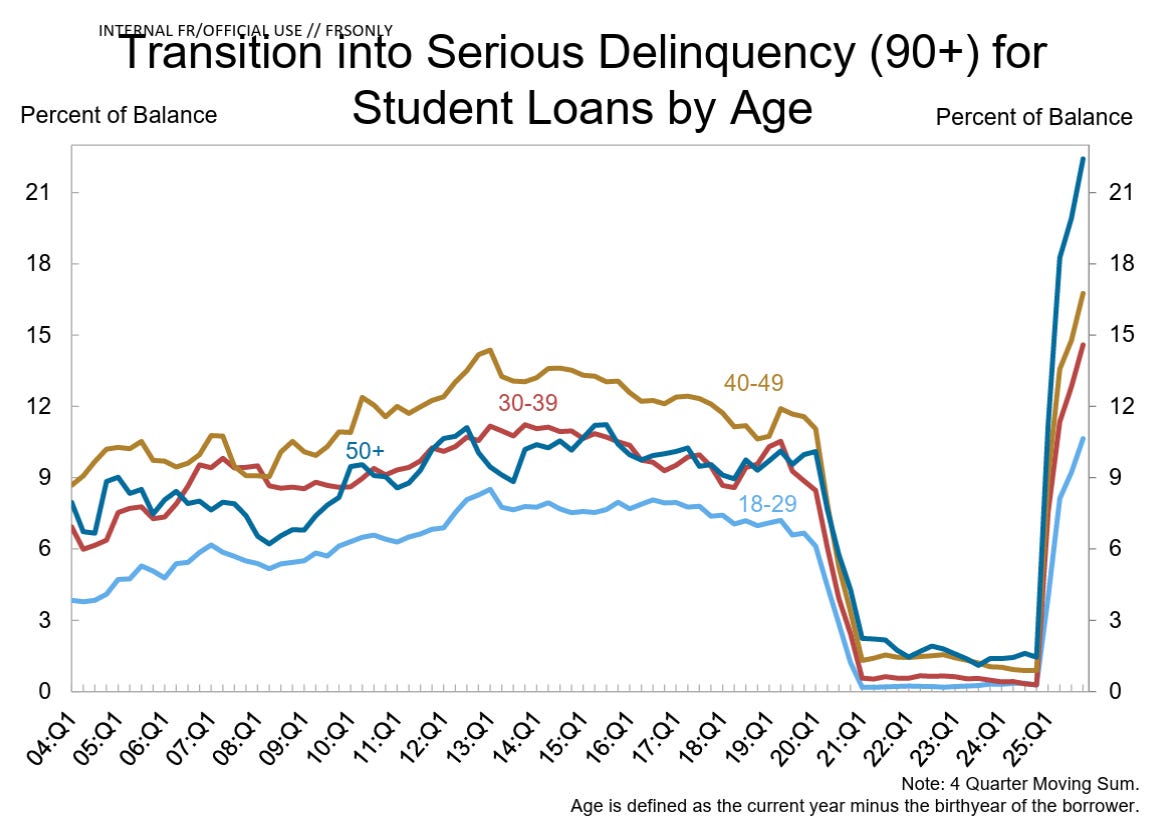

Plus, that’s just a graph of how much debt is already delinquent. For another jump scare, look at the rate at which student loan borrowers, and particularly those aged 50+, are transitioning into serious delinquency:

Bloomberg summarizes: “Some 16.3% of student-loan debt became delinquent in the fourth quarter, the biggest increase on record in data going back to 2004.”

Elsewhere: Middle-class Americans are selling their plasma to make ends meet.

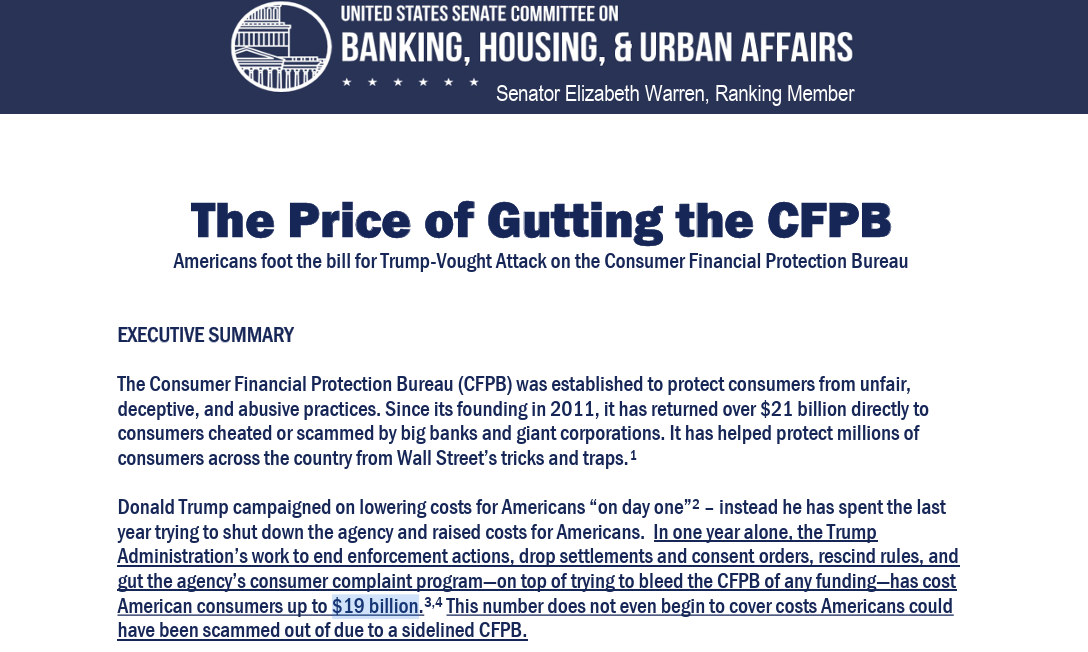

How much has the Trumps’ assault on the CFPB cost Americans? I mean, a literally innumerable amount, but this past week the Dems on the Senate Banking Committee also estimated $19 billion (highlight added):

That number consists of Trump’s political leaders at the Bureau dropping enforcement actions involving $3.5 billion in alleged harm, holding back or blocking $225 million in consumer redress payments, rescinding rules and guidance that “could have saved consumers up to $15 billion,” and killing the consumer complaint response function that could have saved people $40 million. Former CFPBer and current Roosevelt Institutioner Brad Lipton argues those numbers are conservative.

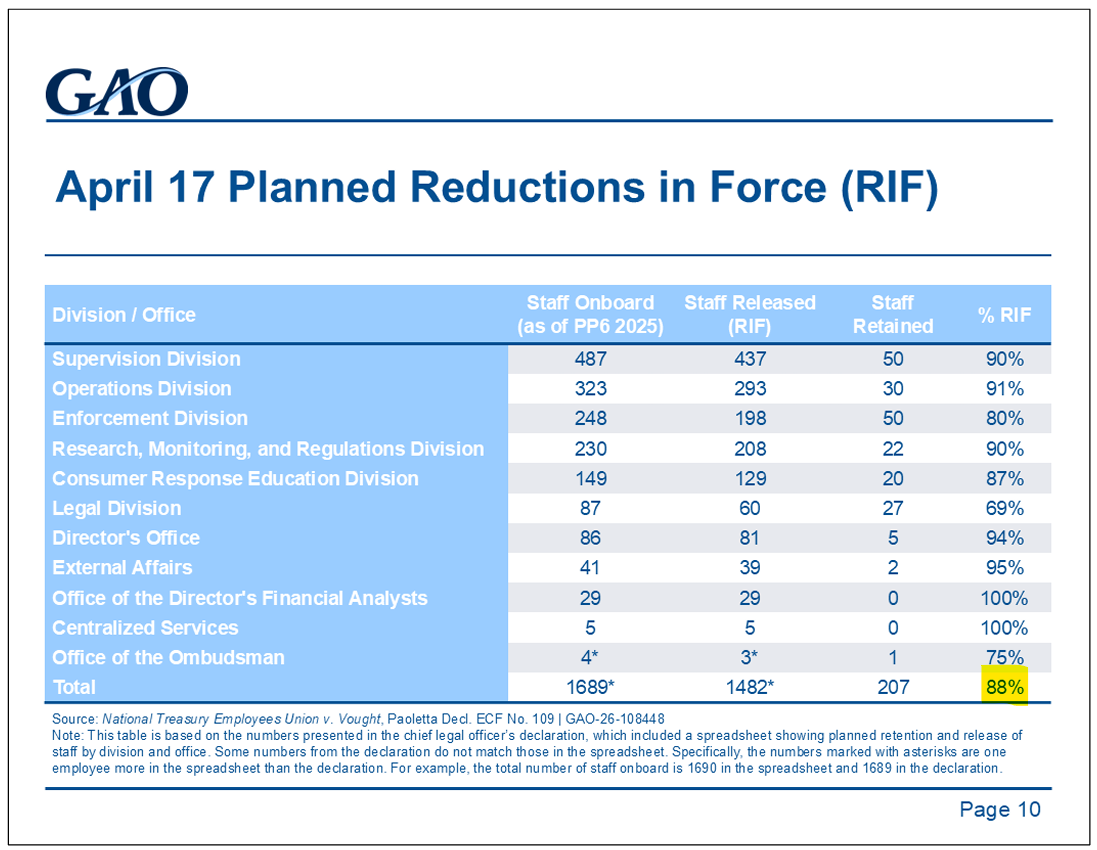

The GAO also published a report last week describing the status of the Trump admin’s “Reorganization Efforts” at the Bureau. The report more a holistic overview than a quantitative breakdown, but it identifies that the DOGE firings that have been held up in court would have cut 88 percent of the staff at the CFPB (highlight added):

Elsewhere: [TX AGO, CFPB, and DOJ] Civil Rights Division Secures $68M Settlement in Predatory Land Sales and Lending Lawsuit (emphasis added):

Colony Ridge targeted Hispanic borrowers with a predatory land sales and lending scheme that led to a cycle of foreclosures and financial hardship in violation of the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act (FHA).

[The settlement includes that Colony Ridge has to] Invest $20 million in increased law enforcement presence to ensure the safety of residents . . . . [what???]

We’ve been talking for a while about how new limits to the federal student loan program in the Big Bill will likely make it so that students do some combo of a) take on a greater quantity of private student loans, which are generally quite expensive and risky, and b) just not go to college. A new report from Senate Dems shows they are already doing at least the first thing (i.e. borrowing more in private markets):

The report shows that some lenders, like SoFi, have seen private student lending more than double since 2022. But I found this part to be the most interesting (I took out the footnotes below, some emphasis added):

Half of the private lenders surveyed either have sold student loans to private equity firms or plan to do so in the future.

Two private lenders, College Ave and Navient, indicated they have sold student loans to private equity firms. College Ave did not disclose the size of such transactions, but Navient reported that it had sold $1.157 billion worth of loans to private equity over the past ten years. Two other lenders refused to disclose whether they had sold loans to private equity or would do so in the future, but one of them, Sallie Mae, publicly announced it would be selling over $6 billion of student loans to private equity a few weeks after providing a response to the Senators.

We’ve recently talked about how Navient and Sallie are relying more on private third parties to secure funding, but the College Ave thing is new. Risky, risky!

Elsewhere: NPR reports that “Millions of student loan borrowers aren’t repaying their loans — and defaults are up.”

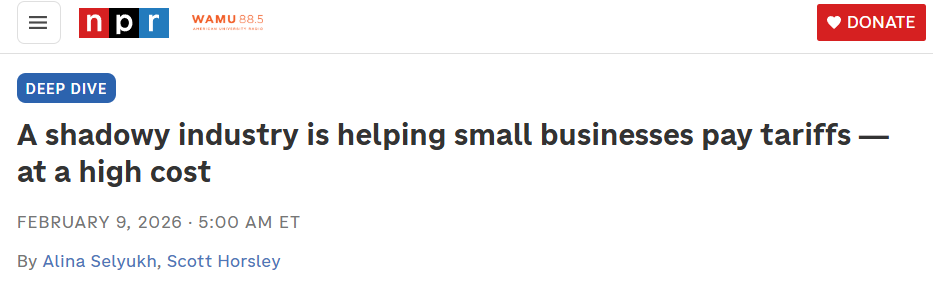

Last week, we talked about how America has spent a long time throwing debt at anything that it could identify as a problem. Well it turns out that a lot of small businesses recently came upon a new problem called “tariffs.” And just like that:

You may have heard of Merchant Cash Advance (MCA) loans, which are just payday loans for businesses. And now they’re payday loans for businesses facing tariffs (emphasis added):

A merchant cash advance, or MCA, is often compared to a payday loan for a business, because this money is quick, convenient and costly. Technically, it’s not a loan but a purchase of a company’s future sales. The lender gives money up front and then takes a weekly or daily cut of receipts directly from the borrower’s bank account until the debt is repaid and then some.

Because these cash advances aren’t classified as loans, most lending laws don’t apply. The lenders aren’t required to be licensed. The fees they can charge have no legal cap. And because this debt is usually due within months, an equivalent annual interest rate can be astronomical. John Arensmeyer, who heads the advocacy group Small Business Majority, says the comparable annual cost averages 94%, and he has seen terms as high as 350%.

The article tells the story of a small biz owner who turned to MCA, as many are now doing, to deal with tariffs. And of course:

In 2023, the federal Consumer Financial Protection Bureau under Chopra tried to require MCA lenders to collect and report data about small-business borrowers. But in November, after Trump’s shake-up, the agency revised those lending rules to exclude merchant cash advances.

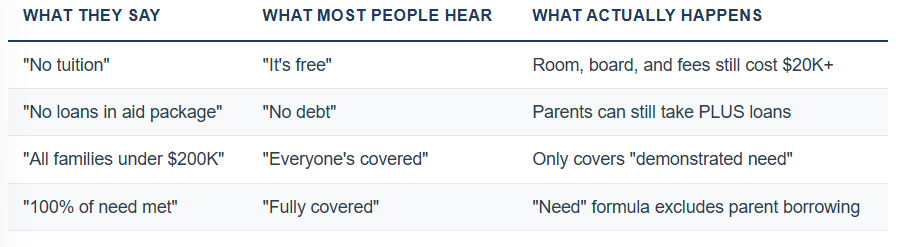

A lot of the more monied colleges (e..g, recently, Yale) have announced that attendance will be “free” going forth for people whose families have incomes below certain thresholds (in the Yale case, $200k). But two recent reports show that families that benefit from these programs still often end up in a bunch of debt.

First, from Daniel Rogers at College Azimuth:

How many loans would a no-loan school loan, if a no-loan school could give loans?

If you said the answer was zero, you’d be wrong. In reality it’s over 20,000 families with over a billion dollars in parent loans outstanding (across the 28 institutions with publicized no-loan or “Free tuition” plans).

The way you know it is actually lower-income households that are borrowing is by looking at whether the student is a Pell Grant recipient. The following table summarizes what’s going on, and I encourage you to go look at the many great graphs in the piece:

Then from New America (emphasis added):

A New America report identifies 41 universities that appear to be steering low-income families to Parent PLUS loan debt they cannot afford, at the same time that they are providing large tuition discounts to wealthier students. The list includes 23 selective private universities and 18 public flagship and research institutions, nearly half of which are in the South.

. . .

Nearly $2 out of every $5 these schools spent on institutional aid that year went to non-needy students—those whom the federal government deems able to afford college without financial aid. Meanwhile, more than 32,000 families of Pell Grant recipients who had either graduated or left these schools in the recent past were stuck with PLUS loans they took out to pay for their children to attend these institutions. These families carried a median Parent PLUS loan debt load of nearly $30,000 each. For many of these families, the amount they owed came close to or exceeded their yearly earnings.

Together, these articles point to how insane and varied the economics of college attendance are across socioeconomic strata. They also underscore how for students from low-income backgrounds, who have less flexibility to shop around among colleges, things remain bad even when they can make it into the wealthy schools.

We now appear to be at the beginning of a bipartisan state enforcement wave, in many ways following a blueprint set out by [Rohit] Chopra during his tenure at CFPB [as Director during the Biden admin].

On the Red state side, the article’s authors point to Texas being “probably the single most aggressive state data privacy regulator last year” and Virginia under its outgoing Republican AG taking action under state and federal law against a solar financing company. Though of course this is just a law firm hawking its services . . .

And finally, some potpourri:

CEO pay at the largest 6 US banks rose 21% to $258 million in 2025.

Senators Cruz and Britt, accompanied on the House side by Andy Barr, introduced legislation to weaken the Durbin Amendment to Dodd-Frank, which caps debit card swipe fees. (Elsewhere: Banks Lose Challenge to Illinois Ban on Tax, Tip Swipe Fees.)

BBerg: Private Credit’s Software Bet Is Even Bigger Than It Appears.

The White House seems to be siding with banks and against crypto in the debate around “yield” payments in the crypto “market structure” bill. (Background here.)

There

is oneare zero enforcement attorneys left in the Chicago office of the CFTC. (Also: the #1 and #2 people at DOJ Antitrust quit.)It seems about 6 percent of annual GDP has been transferred from capital to labor since 1980.

SC Rep Nancy Mace thinks the interest on your boat loan should be deductible.

Epstein files provide a unique look at how the mega-rich spend it (e.g., >$3k on flowers).

Goodyear announces job cuts as tariffs hurt profits.

CFPB Fires Employee Over a Confrontation With DOGE a Year Ago.

“New York’s population of wealthy New Yorkers rose after the two most recent income tax hikes.”

After some reporting about their conduct, “no KYC” cards shut down, boldly try to blame others.

Trump: “I’ve cut hundreds of thousands of jobs.”

BYD overtakes Ford in global vehicle sales. (5 years ago, Ford sold 5 times more cars than BYD.)

Bill O’Reilly refers to Bad Bunny as “the malevolent rabbit.”

Chamath: “We bought a bank.” Community note: he did not buy a bank.

Mmmm, the ornamentation on an 1800s office building in Buffalo.

Goldman Sachs ups its late-night dinner budget for bankers to $35.

A high school assistant football coach in Ohio named Ben Kaufman got promoted from assistant to coach. Congrats, Ben.

Have a great week!

[1] The font downgrade is particularly galling given that the Bureau has otherwise historically taken design seriously. Two examples:

The CFPB paid the fancy design firm IDEO a couple million dollars to craft the agency’s brand identity and consumer-facing materials, including its nice logo; and

The Bureau spent a couple hundred million dollars (ok really $215 million) renovating its office when it first opened.

And I submit to you that both of those things turned out well from a design perspective!

(The journalist Michael Lewis famously said that the CFPB building looks like it was “designed to maximize the number of ledges people would jump off after they had a financial reversal,” but idk, I used to work in that building, and it is very nice. This is also a great moment for us all to remind ourselves that CFPB funding does not come from direct taxpayer dollars, so relax.)

And for those who object that the CFPB’s official seal is kinda bad, that was signed off on in 2018 by Trump-appointee Mick Mulvaney, who is known mostly for other work.