This Week In Debt: 1/19/2026

This thing goes all the way to the top.

Hi,

Last week, the CFPB’s newly anointed Student Loan Ombudsman Geof Gradler released his office’s statutorily required annual report about goings on in the student loan space. Gradler (who, like you, I had not heard of until a few days ago) is a former lobbyist who worked for Charles Schwab for ~20 months in the aughts and for Alabama Senator Richard Shelby before that.

The media correctly identified the report as a dud that had fallen victim to political sabotage. But I submit to you that the events around its publication paint an even more damning picture of self-dealing and industry capture than the conversation to date has properly recognized.

To review: the law that created the CFPB is called the Dodd-Frank Act, and that statute requires the Bureau to have a student loan ombudsman. That ombudsman has a variety of responsibilities, including helping individual borrowers navigate their loans when they report problems and publishing a report every year about developments in the broader student loan market. In addition, Congress designed the ombudsman role to be fully independent from management at the CFPB and at the Department of Education (ED), which is where most student loans come from. That way, the ombudsman would be able to do the work of protecting student loan borrowers without interference from political leadership.

The CFPB named Julia Barnard as its student loan ombuds in March 2024 (that is, during the Biden era). Barnard was a CFPB veteran who had previously worked at the Center for Responsible Lending. She tried to do right by student loan borrowers and to speak up for the harms they were (indeed, still are) facing.

Leaders in the second Trump administration, however, set out almost as soon as they took office to undermine the ombudsman’s independence. The sabotage mentioned above started long before Gradler began drafting whatever it is that the Bureau eventually published.

First, in early 2025, ED hired James Bergeron both to lead the office in charge of the federal student loan system and to act as the Under Secretary of Education (that is, the Secretary’s most important deputy). Bergeron is a former lobbyist for one of the most notorious student loan companies in the world, MOHELA. Nick Kent, himself a former lobbyist for for-profit schools, eventually replaced Bergeron in his modality as Under Secretary after he (Kent) secured Senate confirmation.

Then, per reporting published last week, the new political leadership at ED directed their staff not to assist Barnard and her team on anything related to student loans. Finally, ED management directed Barnard’s team to back off entirely from work related to federal student debt, which constitutes more than 90 percent of the student loan market.

Adding insult to injury, it appears the CFPB’s political management under Trump-era Acting Director Russ Vought sided with leadership at ED in favor of sidelining Barnard and the ombudsman’s office. Barnard’s original annual report—which was ultimately shelved in favor of Gradler’s, but has since become available online—detailed how she had to fight through reduced resources and hostility from above just to finish her statutorily required work.

The result is that the Trump administration basically succeeded in undermining an independent watchdog so that it could protect predatory student loan companies. The disappointment of last week’s report is just a symptom of a broader scheme, the seeds of which the folks at Protect Borrowers warned about last year. Rather than have an ombuds with the latitude and power to call out bad student loan companies and for-profit schools, we have cronies for bad student loan companies and for-profit schools silencing those who would hold them accountable.

In light of the stuff that Barnard’s now-public report did find—from private student loan companies ripping off defrauded students to escalating defaults among borrowers trapped in an unworkable system—that outcome is particularly tragic.

Ok, ok, let’s lighten up. Man, I am really not beating the ChatGPT allegations with the use of this many em dashes. Anyway, it’s time for the best of the internet from the past week on the topic of debt and its consequences for the rest of us. Those links are below! Feast.

So without further ado . . .

This Week In Debt: 1/19/2025

Still in student land: bullying works! The Department of Education announced Friday that it would give up plans to garnish the wages and take away the tax refunds of people who are in default on federal student loans (emphasis added):

The U.S. Department of Education (the Department) today announced that it will delay the implementation of involuntary collections on federal student loans, including Administrative Wage Garnishment (AWG) and the Treasury Offset Program (TOP). The temporary delay will enable the Department to implement major student loan repayment reforms under the Working Families Tax Cuts Act (the Act) to give borrowers more options to repay their loans.

(The Working Families Tax Cuts Act is the part of the Big Bad Bill that deals with changes to the tax code.) Recall from last week that the Trumps were about to turn back on certain federal student loan debt collection machinery that has been left off since COVID, including wage garnishments and the seizure of tax refunds. The delay that the Department announced Friday came after substantial pestering from consumer advocates about how restarting those collection strategies could push millions of people further over the financial edge.

Elsewhere in student loans:

Via Daniel Rogers: The Family Debt Reality: It’s not just Student Debt, it’s Family Debt (emphasis added):

Most college finance discussions focus on student debt alone. But families borrow as a unit — and when you add parent borrowing, the picture changes dramatically. 400,000 families — 43% of Parent PLUS borrowers at median income — can’t sustainably carry their debt. At private nonprofits, 58% of families are underwater.

Our analysis finds that Three-quarters of Parent PLUS borrowers at median income are in “high pressure” territory.

MOHELA Hit With Fresh Charges of Ongoing Student Loan Mismanagement (see, notorious).

Cornell, Georgetown, UPenn must face lawsuit over financial aid.

Department of Education Panel Signs Off on New Earnings Test.

The Trump v. credit card interest rates saga continues. When I was last in your inbox, Trump had just called for a one-year, 10 percent cap on credit card interest rates and said that companies that don’t fall in line will be “in violation of the law.” Which law? You know, the law. (To be clear, being in law school, I have a certain admiration for all of this.)

The deadline to comply with the 10 percent thing is tomorrow, so at least the admin gave the banks MLK Day to get their ducks in line. One company, Bilt, is already complying, but ehhhh junk fees. In the meantime:

The Trumps may take “executive action” if Tweeting/Truthing fails to bring about a 10% rate cap.

I put “executive action” in quotes above because the article makes clear that nobody, including the admin, has any idea what that actually means here. But early guesswork indicates that “executive action” might involve the Trumps using the promise of deregulation as a carrot to incentivize the lowering of credit card rates (emphasis added):

The plan, which is still being crafted as administration officials discuss the terms with industry and Congress, is designed to lower interest rates on credit cards as part of a broader push to reduce costs for Americans, according to people familiar with the matter. Trump’s action may also call on regulators to relax certain liquidity standards to help make the plan more attractive for the banks, said the people, who asked not to be identified citing private discussions.

Ughhhh.

Relatedly, from Luke Goldstein at the Lever: Trump’s Playing Both Sides Of The Credit Card Fight.

Perhaps more importantly, Trump endorsed Dick Durbin and Roger Marshall’s Credit Card Competition Act (CCCA).

There’s a good explainer on the bill here from Brendan Peterson at Punchbowl, who calls CCCA “probably the single most lobbied-about bill, as far as the banking sector is concerned, over the last several years.”

The bill is more or less an effort to reform the swipe fees that Visa and Mastercard charge merchants to use their (the card companies’) credit card payment rails. Visa and Mastercard’s rails control more than 80 percent of credit card payments in the U.S., and Americans pay uniquely high swipe fees compared to global peers due in part to the lack of competition.

Simplifying, CCCA would require the largest banks that issue credit cards to have their cards be able to access at least two payment networks (one of which has to be a payment network that is not Visa or Mastercard). Ideally, this would force more competition in payments and drive down costs (i.e., swipe fees).

This article gives a flavor of how the counterarguments (fewer CC rewards, worse data privacy, and diminished credit access, maybe?), none of which struck me as that compelling.

In The Contrarian, former CFPB Director Richard Cordray connects the dots on how a hobbled CFPB hurts affordability for working families (emphasis added):

Nothing undermines affordability like getting ripped off without having the right officials on your side who can and will do something about it. And nothing encourages abusive conduct like companies knowing that if they rip people off, those officials have been idled and will no longer stand in their way. This is an unnecessary problem that can readily be fixed. One way to address the problem of affordability is simply to let the CFPB do its important work.

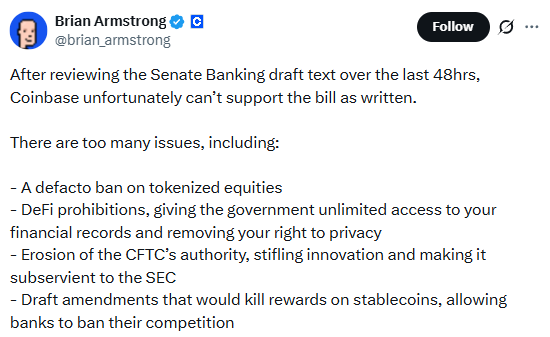

If it isn’t clear yet, I sort of hate writing about crypto. But I described last week how efforts to pass a “crypto market structure” bill were blowing up in the Senate, and this week they fully combusted. At least for now.

Basically, the CEO of Coinbase pulled his support at the last minute in a tweet. I don’t want to give it airtime, but I think his tweet is a great example of how whiny and entitled crypto people are:

Two quick points, because, again, I think that’s all this deserves:

On his fourth point: I mentioned last week that the fight about “rewards” is about crypto companies trying to effectively offer banking services. Crypto people usually argue that “rewards” are not interest payments, and are instead a secret third thing, because crypto people don’t want to concede that their stablecoins are actually just unregulated deposit accounts.

But then here the Coinbase guy just goes ahead and tweets out that rewards matter for stablecoins because they have to be available so that stablecoin companies can compete with banks. Yes, Brian, to compete . . . for the provisioning . . . of BANKING SERVICES. My god slam my head against a wall.

On his third point: The CFTC thing he’s complaining about is this (summarizing): the CLARITY Act might MINIMALLY diminish the Commodity Futures Trading Commission’s ability to sell regulatory arbitrage to people who invent purportedly novel financial things, because it articulates that even SOME crypto things belong under the SEC’s purview. Idk, I was told for years that the crypto people just wanted regulatory CLARITY? (e.g.) No, no, I forgot, Brian is a very special boy, and we are all required to believe he has a god-given right to regulatory arbitrage.

It does seem like this thing will pass in some form, though there are hurdles.

Elsewhere: Coinbase CEO tweets in open support of sanctions evasion.

Fair lending grab bag!

On a podcast hosted by a law firm that does a lot of industry-side consumer finance stuff, the civil rights lawyer Stephen Hayes of Relman Colfax did a great job pushing back on the idea that the way DOJ uses data in fair lending analysis raises constitutional problems. The American Bankers Association proposed that idea in a report back in May, and Hayes dispatched with it in an article in American Banker in October.

Bloomberg: Banks Silent on Trump Plan to Weaken Racism-in-Lending Rules.

BLaw: CFPB Puts Diversity Office Director on Administrative Leave.

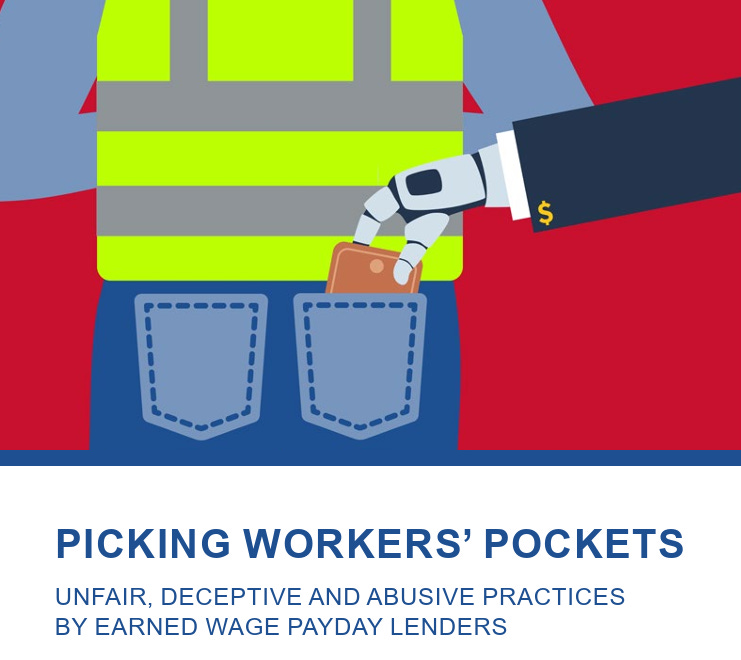

Great new report on “Earned Wage Payday Lenders” from the National Consumer Law Center!

The report identifies a huge set of harmful practices in wage advance products, saying “[t]hese practices are a stark warning against efforts to exempt earned wage payday loans from lending laws and may support claims under federal and state UDAP laws.” That includes:

Deceptive and manipulative practices regarding costs, including:

Disclosing 0% APR, “no interest” or “interest free” even as up to 90% of users pay costly fees that can cost on average $300 a year and as high as $1400 over two years.

Promoting “instant” or “fast loans,” while hiding high “expedite” fees that almost all borrowers pay.

Delaying disbursement or exaggerating the amount of time needed for delivery if the borrower does not pay an “expedite” fee.

Obscuring costs by hiding them on websites and apps or not fully disclosing them until the borrower is deep into the sign-up process for the loan.

Dark patterns that are unfair or abusive tricks to make free options illusory and coerce purportedly voluntary “tips” and “donations,” including:

Using default options that include costs automatically.

Deceptive and manipulative user interfaces that steer users towards accepting advances with costs or make it difficult to avoid tips.

Repeated requests for tips and interfaces that require multiple steps to avoid a tip.

Deception around the purpose of a tip or amount of funds being donated.

Psychological manipulations and guilt, including implied threats of consequences for borrowers who do not tip.

Advertising large loans that few borrowers receive and limiting loan size or pushing smaller loans to multiply fees.

Creating obstacles to prevent borrowers from canceling.

Lending regardless of whether borrowers can afford to repay without further loans, leading to a cycle of dependence on new earned wage payday loans with additional fees.

On the state and local front, the Times has a great profile of former FTC Consumer Bureau Commissioner and new NYC Department of Consumer and Worker Protection Commissioner Sam Levine (emphasis added below):

In his first days on the job, Mr. Levine asked department employees to ramp up their scrutiny of food-delivery companies, which already face stricter regulations in New York City than anywhere else in the country, including minimum pay requirements for drivers.

In response, DoorDash and Uber Eats both changed their apps to make the option to tip delivery workers available only after a purchase had been completed. Mr. Levine had the department calculate the decline in tips that drivers for those companies had received after the changes.

The resulting report, which caught both companies by surprise, was released on Tuesday and said that $550 million in tips had been lost.

And finally, some potpourri:

E.P.A. to Stop Considering Lives Saved When Setting Rules on Air Pollution.

Vail Resorts: Skier visits fall 20% year-to-year.

The Economic Populist: Trump Killed the CFPB’s “Open Banking” Rule. Now Big Banks Are Crushing Your Favorite Finance App.

FDIC Tells Staff to Narrow Bank Examinations Ahead of Final Rule.

NYT: Push to Audit Private Equity and Venture Capital Falters Under Trump:

Progress on complex audits has slowed to a trickle, tax lawyers who specialize in these cases said. The number of large partnership exams has not gone “completely to zero, but it has certainly dropped 80 or 90 percent,” . . . .

Chasse Rehwinkel in Open Banker: Private Credit: The Next Shadow Banking Hazard?

Great thread from Chris Murphy on the commodification of everything (notice that the prediction market screenshot in his tweet involves people betting on when/if Israel will strike Gaza):

“The 1998 paper that introduced Google and PageRank to the world ends with this acknowledgment: Supported by the National Science Foundation . . . . Funding also provided by DARPA and NASA.” (Google is now worth $2 trillion, and public research funding matters!)

Now in control of Afghanistan, the Taliban is having its own Jeffersonian/Hamiltonian split (emphasis added):

One entirely loyal to Akhundzada, who, from his base in Kandahar, is driving the country towards his vision of a strict Islamic Emirate - isolated from the modern world, where religious figures loyal to him control every aspect of society.

And a second, made up of powerful Taliban members largely based in the capital Kabul, advocating for an Afghanistan which - while still following a strict interpretation of Islam - engages with the outside, builds the country’s economy, and even allows girls and women access to an education they are currently denied beyond primary school.

One insider described it as “the Kandahar house versus Kabul”

Trump maybe had a stroke a couple months ago.

26 people charged in connection with alleged basketball game fixing.

Have a great week!