This Week In Debt: 1/26/2026

The seven stages of credit card grief, UHG loan sharking, Sallie Mae earnings, etc etc.

Hi,

One way to think about it is that the world is going through the seven stages of grief on credit card reform:

Shock: “Credit card stocks sink after Trump proposes interest rate cap.”

Denial: “[T]he 10% credit card interest rate cap won’t happen” (because it would hurt stocks and then Trump would chicken out; not a bad intuition to have!)

Anger: “Trump credit card plan would be a ‘disaster’, JP Morgan boss warns.”

Bargaining: WSJ: “How Banks Can Appease Trump on Credit-Card Rates.” The article basically points out that in a lot of to past instances where Trump made big threats (tariffs, etc), he eventually opted for a less-disruptive but still symbolic public win. Maybe, the author speculates, that kind of thing can happen on credit cards (emphasis added):

Top economic adviser Kevin Hassett, in earlier comments to Fox Business Network, suggested banks could voluntarily issue some type of “Trump cards” for people with insufficient access to credit.

This appears to be the kind of thing that has settled disputes with other industries. It could be a Trump-branded victory for the president, with quantifiable benefits for a key constituency—but also not a disruptive change to the core economics of banks.

And look at that! NBC: Bank of America considers new credit card capped at 10% interest (but this would just mean BofA introducing a new product, not killing other ones it offers that already have rates above 10 percent).

Depression: GOP pollster Frank Luntz cries at the polling.

Testing (defined more or less as finding coping mechanisms): Punchbowl reports that the Credit Card Competition Act is gaining momentum. (Detail on that bill here.) One way you know the bill is moving: the Senators running it (Durbin, the Dem from Illinois, and Marshall, the Republican from Kansas) have advised people to put the Republican’s name first when talking about it.

Elsewhere: Fix Credit Card Competition with Market Improvements, Not Rate Caps.

Acceptance: Republican and former FDIC chair Sheila Bair in the FT (emphasis added):

The industry claims a 10 per cent cap will make it unprofitable to serve all but the safest cardholders and force it to withdraw credit from millions of customers. But the evidence suggests that banks have a lot of room to reduce rates and still make tidy profits without cutting back on credit availability for most.

None of the above is to endorse or criticize any particular path to reform on credit cards. But it is definitely to observe that attention from the executive branch, Congress, and the commentariat all appear to have converged in that special way on the idea of “credit card reform,” for some meaning of the phrase. And so it certainly seems more likely than not that something’s gonna happen. We’ll see what that means! I’m just not sure that the symbolic gesture of banks adding a card with a 10% rate to their product mix is going to be the end of the story.

(Meanwhile, as a datapoint on whether credit card people think the sky is going to fall in their industry: Capital One, which is a bank that derives most of its profits from credit cards, announced this week that it will spend $5.15 billion buying the credit card company Brex. Not something you do if you think the CC business is about to implode!)

Anyway. You have come here for links and takes on consumer debt and its consequences for the rest of us, and boy have I delivered. See below for all the news that is fit to email.

So without further ado . . .

This Week In Debt: 1/26/2025

You’ve heard of medical debt, but the intersection of debt and healthcare is both bigger and worse than we imagine. From the American Economic Liberties Project this week, in the Economic Populist:

Basically, UHG (yes, the health insurance company) started a bank subsidiary in 2003 so that it could make money managing HSA deposits. Then, in 2023, it started “selling payday loans to physician practices.” Here’s what that looks like (emphasis added):

Unlike a typical bank, Optum Financial pocketed 35% of the total loan amount, and UnitedHealthcare – the company’s insurance arm – garnished the borrower’s claims reimbursements as a means of repayment.

Oof! Per the article, this got really bad around “emergency” loans that UHG made to certain smaller medical providers in 2024 after a cyberattack cut off those providers’ payments (emphasis added):

[I]n early 2025, Optum Financial abruptly demanded full repayment within five business days, threatening to garnish providers’ claims payments if they didn’t comply, further compounding their financial losses as a result of the attack.”

Seems bad!

Sallie Mae, which is basically the only bank in the U.S. that more or less just does private student lending, released its Q4 2025 earnings last week. The verdict: business is booming, and Sallie predicts $5 billion in additional originations per year (a 70% increase) thanks to the Trump admin.

Reiterating that the new Sallie logo looks like the Mondelez logo. Recall: the Big Bad Bill placed huge new limits on the availability of federal student loans. The explicit goal of that move was to have private student lenders take on a bigger role in higher ed access. Of course, the resulting reality is more likely to be some combo of people taking on a greater volume of private student loans, which are way riskier than federal student loans, and people just not going to college because they can’t get the funding they need. (About 40 percent of students could be in the latter camp.)

But hey, high times for Sallie in the meanwhile! Bits from their earnings call include the following (emphasis added throughout):

Regarding the elimination of PLUS loans (a type of federal student loan) in the Big Bill, Sallie’s CEO said:

We believe that when fully phased in, PLUS reform could contribute an estimated $5 billion in annual originations for Sallie Mae representing approximately 70% originations growth over 2025.

Sallie is going to be increasingly reliant on private credit lending to meet origination demand (I noted a couple months ago that Sallie had announced a partnership with the private credit [yeah yeah and other stuff] firm KKR; this builds on that):

[W]e estimate that roughly 30% to 40% of our private student lending originations will flow through strategic partnerships [with private credit lenders], with additional balance sheet growth managed through seasoned portfolio loan sales.

That is, they’re going to meet demand for PSLs without growing their own balance sheet by originating a bunch of loans and immediately selling them to private credit firms.

Moolah, baby! Sallie confirmed it conducted $373 million in buybacks in 2025, and announced it had authorized up to $500 million in fresh buybacks over the next two years. Sallie stock rose like 8 percent on its earnings.

This is not the first time I’ve discussed execs at private student loan companies getting excited in earnings calls about the Big Bill and the help DJT has extended them (see, e.g., SoFi). I’d wager it won’t be the last.

Elsewhere in student lending (look humor me here): most people don’t know this, but the UK actually has a small federal student loan programme, and it’s going badly. In the Times of London (emphasis added):

Of those British graduates who made a repayment towards their student loan in the 2024-25 tax year, some 2.73 million accrued more interest than they repaid — at least 67 per cent of the total. This was up from 2.64 million in 2023-24.

The figures were obtained by Times Money through a freedom of information request to the Student Loans Company.

. . .

In the same period, £15.2 billion of interest was added to student loans, while only £5 billion was repaid, raising questions about the repayment system, and the impact it has on the future finances of millions of young people.

The Student Loans Company! Adorable.

How’s private credit doing?

Ope! And notice how this connects to the Sallie story above. Public policy now relies on private student lenders stepping in to ensure continued access to higher education. In turn, those lenders stepping in appears to rely on the availability of private credit to provide lendable dollars. What happens, Sallie, when the private credit runs out? And what will that mean for students?

Recall: one of the last straws that necessitated the federal takeover of the student loan program in the first place was that the general seizure of credit markets in Financial Crisis caused private student lending to essentially disappear overnight, raising the risk that basically nobody would be able to go to college.

I wrote a little while ago about how “everyone” (Bloomberg’s words, not mine) suddenly wants to be a bank. (See the UHG story above! Though they became a bank decades ago.) This was fun in part because the industry and its lobbyists have long complained that post-Crisis reforms (Dodd-Frank et al.) had allegedly made being a bank so lame and onerous that nobody would ever possibly want to become or remain one.

Now, let’s expand on what we learned. It seems like everyone now either wants to become a bank or to become as much of a bank as possible without formally becoming a bank. The latter is not necessarily a new impulse—people have always wanted to get the benefits of being a bank without having to take on the responsibilities of being one—but it’s interesting that the two trends are coinciding.

And so, here are some stories from the week:

First, a bunch of companies across a range of sectors are getting and trying to get banking licenses:

Affirm (a fintech point-of-sale lender):

Trump-affiliated vague crypto thing “World Liberty Financial:”

And more generally, Banking Dive reports on an “explosion of banking charter applications.”

Then there’s folks who want to do the business of banking without being banks. Credit Unions are in there and had some commentary this week, but theirs is a more complicated story, so let’s talk crypto.

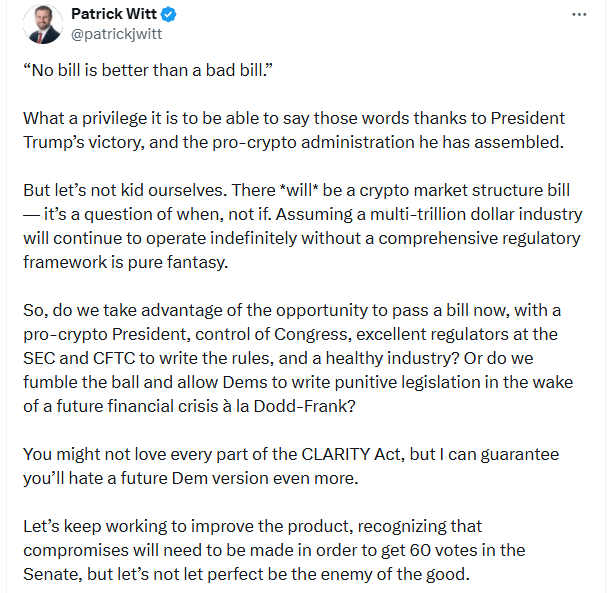

As we discussed last week, the crypto industry has been trying to pass a so-called “cypto market structure bill.” One of the big sticking points there has been certain practices that crypto companies engage in and that amount (metinks) to offering banking services, but that the crypto world does not want to call banking. When we last spoke, the bill had blown up over whether it would allow those practices, and the head of the big crypto exchange Coinbase had more or less suddenly walking away from the deal in a huff after years of negotiation.

Things got worse for the crypto bill this week, but they also may have gotten funnier. One criticism of the Trump administration is that even if you try to negotiate with them in good faith, they will screw you and do whatever they want. Well, that’s that’s sort of what the Coinbase guy did to the Trumps, and this week the administration did not take its own medicine well. Here’s a White House person talking about Coinbase abandoning the crypto market structure bill:

It is very funny to see this guy agree that crypto is going to cause a crisis, and even funnier to see him say, “we gave you everything, how dare you say that isn’t enough???”

The bill is now on the backburner. On the Banking With Interest podcast, however, Brendan Pederson of Punchbowl notes that crypto lobbying involves more than Coinbase, and he basically agrees with Witt above that something is eventually likely to pass. We’ll have to wait and see, though, how much of crypto is ultimately allowed to do banking, and how much of that it will have to call banking.

Then there are actual banks. What those guys want is pretty clear: to be banks that are less regulated. And they are basically getting their wish! Some stories this week to that end:

BBerg: How Trump Is Rewriting the Rules for America’s Biggest Banks (basically a great primer on banking dereg to date under Trump 2.0)

BBerg: Regulator Says [It] Eased Bank Rule to Curb Private Credit Demand

The Office of the Comptroller of the Currency said the agency’s efforts to relax post-crisis leveraged-loan rules for banks will help lenders compete with the private credit industry.

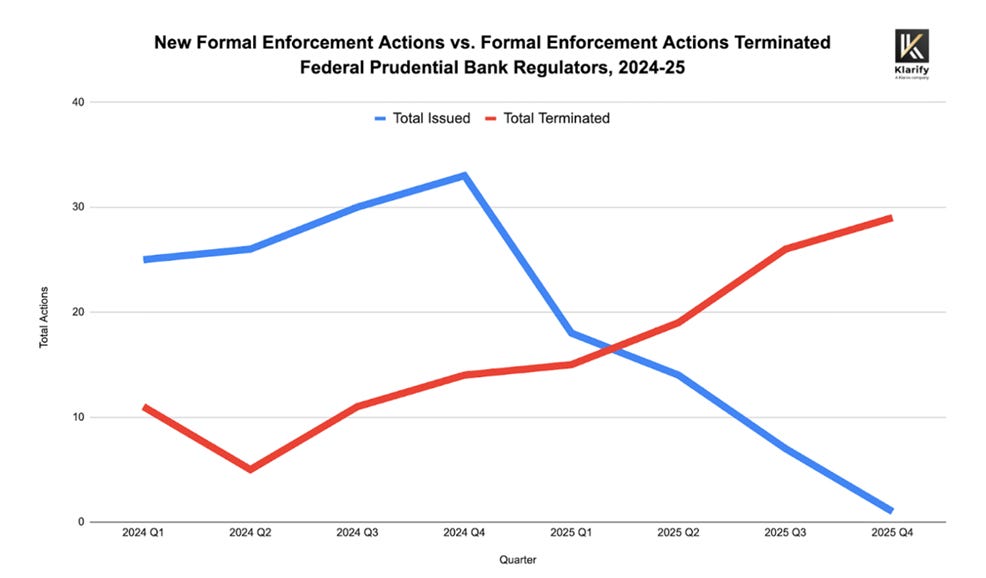

Klaros Group asks “How quiet is it on the enforcement front?” The answer: “Formal enforcement activity by the federal banking agencies has . . . . effectively ceased.”

Elsewhere, on the CFPB: 1 year into Trump’s new term, an agency that protects your finances is ‘hanging by a thread.’

This is dumb, but do keep an eye on it:

That is, Trump sued JPM and its CEO for a made-up number based on the accusation that the bank improperly cut off Trump et al. from banking services after January 6th. The complaint in Trump’s case is here, and it’s basically what you think it is. Trump’s lawsuit comes amid a broader campaign of conservatives alleging that they have purportedly been unfairly and illegally “debanked” (that is, had banking services cut off for political reasons), and we’ve discussed how those allegations are total BS.

Still, as I talk about a lot here, banks are franchisees of the government (that is, they exist because the government has given them permission to privately carry on the public work of money creation). That fact means that the government ultimately has a lot of soft-power tools it can use to influence banks’ behavior. And so even if the lawsuit above appropriately fails, it could still signal coming headaches for JPMorgan, as Trump is still the guy at the helm of the soft-power apparatus that regulates and supervises the bank. Idk, expect Trump to demand his pound of flesh from Jamie Dimon, even if it’s not the $5 billion he’s asking for in the lawsuit.

But on the more meritorious front: a new, first-of-its-kind Fair Credit Reporting Act lawsuit about AI employment screening! (emphasis added below):

[A] lawsuit filed by a group of job applicants claims that some A.I. employment screening tools should be subject to the same Fair Credit Reporting Act requirements as credit agencies. The lawsuit’s goal is to compel A.I. companies to disclose more information about what data they are gathering on applicants and how they are being ranked.

The target of the suit is a screening company, Eightfold AI, that sells its technology as a tool for employers to save time and money. Using sources like LinkedIn, Eightfold has created a data set that it says encompasses more than “1 million job titles, 1 million skills, and the profiles of more than 1 billion people working in every job, profession, industry, and geography.”

. . .

“There is no A.I. exemption to our laws,” said David Seligman, executive director of Towards Justice. “Far too often, the business model of these companies is to roll out these new technologies, to wrap them in fancy new language, and ultimately to just violate peoples’ rights.”

As the article explains, FCRA “defines a ‘consumer report’ as any gathering of information on someone’s ‘personal characteristics’ that is used to determine their eligibility for various financial services or ‘employment purposes.’” So if an AI company is gathering info on you for an employer, you already have the right under FCRA to know about it, dispute inaccuracies, etc.

A new report from the Center for Responsible Lending finds that Minnesota’s elimination of payday lending didn’t lead people to turn to loan sharks—it led them to use affordable alternatives that were already available, but that they might not have previously considered.

The story here is something something informational frictions (emphasis added):

Research from the Department of Defense shows that people facing financial distress tend to draw from a narrow “consideration set,” shaped by aggressive marketing, behavioral biases, and misconceptions about eligibility for other forms of help. As a result, many borrowers believe they have no real options beyond payday loans. Removing payday lending from the marketplace broadens this consideration set by prompting borrowers to explore non-predatory resources such as nonprofit assistance, financial counseling, and coaching.

The findings above are consistent with the view that payday loans are more a tool to generate demand for credit than to meet it. That view rests on the observation that payday lenders really only make money when you can’t afford to repay your loans and have to roll them over into new ones, a move that requires paying a fee. If that narrative is correct, then banning payday loans would not mean actually diminishing credit access, it would just mean cutting off debt traps. And that appears to be Minnesota’s experience.

And finally, some potpourri:

Capital One Cafe discourse continues (recall my opening salvo), and of course there is a zoning angle (click into the replies)!

Treasury yields jumped after the Trump Greenland thing and have remained elevated, counteracting presidential efforts to lower mortgage rates.

China Purchases No U.S. Soybeans for “Unprecedented” Fifth Straight Month.

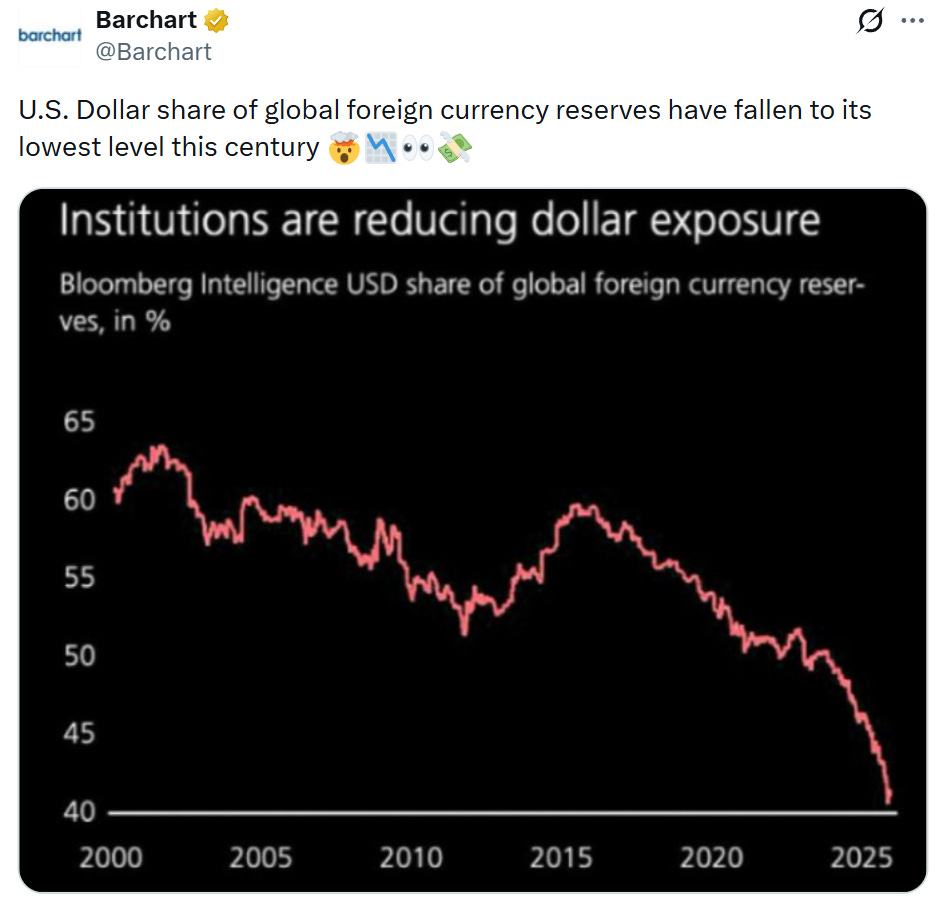

People are really running away from dollars:

Also here.

BBerg: Fannie, Freddie Stock Woes Deepen as IPO Questions Mount.

Mamdani Administration Bans Hotel Hidden Fees and Unexpected Credit Card Holds.

The Economist: Southern Europe now has a lower headline unemployment rate than Northern Europe. (It is usually the opposite.) Elsewhere in surprises: Japan’s 40-year bond hits 4 percent for the first time ever.

I tried very hard to find a consumer finance angle for the ongoing Beckham family drama, and I failed. Anyway, there is ongoing Beckham family drama. My real take is that Brooklyn Beckham looks like Josh Hutcherson + a lost Sprouse twin.

CNN: DOGE shared Social Security data to unauthorized server, according to court filing.

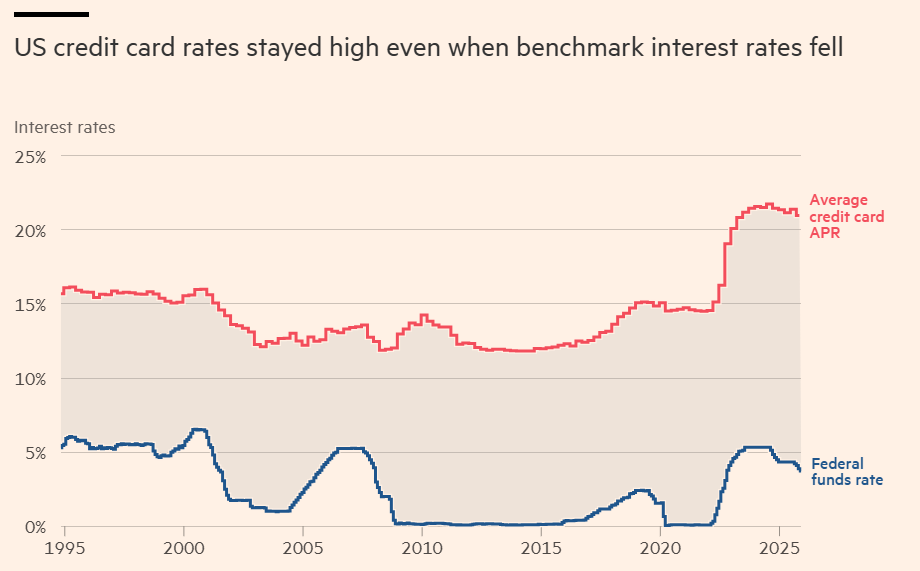

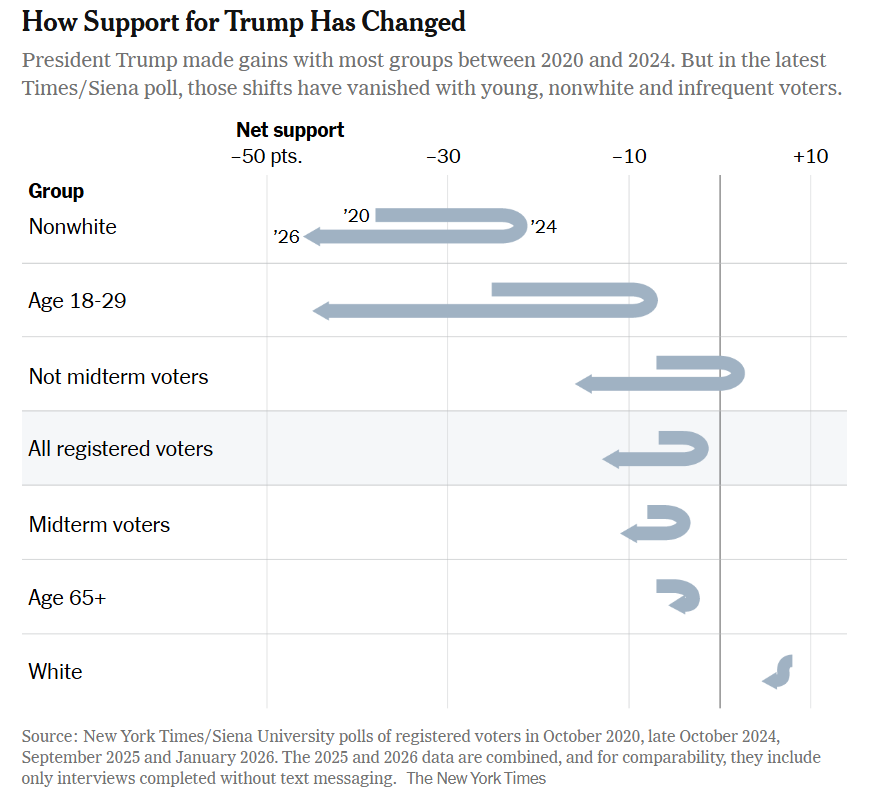

Mmmm, graphs. An extremely well-done one from the Times:

Also NYT: D.H.S. Cited Foreign Students’ Writings and Protests Before Their Arrests.

It’s 2020. The husband of a former teacher, wearing aviators, is speaking out against Trump. It’s 2026. The husband of a former teacher, wearing aviators, is speaking out against Trump.

Also:

Grassley, Rounds, Colleagues Push DOJ, FTC to Renew Robinson-Patman Act Enforcement, Protect Small and Medium-Sized Businesses From Economic Discrimination.

Cory Lewandowski caught “loudly talk[ing] about Palantir and drone contracting issues” in public at Dulles.

Articles in the Atlantic attribute ongoing declines in fentanyl overdoses and crime to Biden-era policy changes.

WSJ: Dos Equis Brings Back the Most Interesting Man in the World.

TMZ: William Shatner is photographed eating a bowl of cereal in his car at a stop light.

Nothing but respect for MY president: Al Gore booed Howard Lutnick during Davos speech.

Apparently in the works: “Kenan & Kel Meet Frankenstein.”

1980s NYC “Subway Vigilante” Bernie Goetz, unlikely urbanist? (“‘NYC is nothing like it was 40 years ago,’ he wrote in a recent email. ‘Good shopping and you don’t have to own a car.’”)

Very cool essay in Quartz: I’m a data scientist who is skeptical about data.

Women in male-dominated fields: Former FTX crypto executive Caroline Ellison released from federal custody; Elizabeth Holmes [of Theranos] asks Trump to let her out of prison early.

Have a great week!